- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,066

i agree in general , and have learned to be suspicious when a small under-performer hires a 'high-profile ' exec. , but investing is also about spotting the actual opportunity as well .

One always needs to assess if a company is 'investment grade'. When I was a young and beeuutiful lass, I would assess a bloke as in is he a long-termer, a mid-range squeeze or just good for a quick slap and tickle? This is what I do with stocks as well.

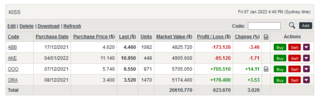

As far as TLS is concerned, I hold but I can see TLS is more your mid-range squeeze. I did a swing trade calc on it and have assessed a price and put a for-sale-sign out on it. There is a very long term falling overhead-trendline coming up shortly and it pretty much matched the swing trade calc. I think that is as far as it will go and have priced it for sale just under that line. If I am wrong, then nothing lost, I can go back in if it succeeds to maintain a level above the falling trendline. I doubt it though, I reckon it is headed in the same direction as AGL and all the other shorted-to-death stocks.