- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

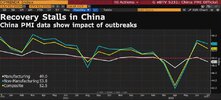

Expectation vs reality. If things aren't as bad as expected, we play ball.

I'm now getting full on FOMO for a SOXL play. Even crypto's back on the menu now.

Expectation was for a positive GDP though, reality was worse... Same for GOOG and MSFT earnings

The FOMO is strong.

Looks like AAPL and AMZN have both beat estimates, albeit by tight margins. BTC has followed (or has it lead?). Most risk assets seem to be approaching some important resistance, meanwhile the FANGs have all reported.

Does the market have any more positive news to report or is it going to be negative earnings from here on?

Last edited: