- Joined

- 3 July 2009

- Posts

- 27,642

- Reactions

- 24,535

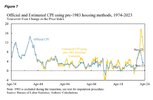

The plebs are getting nervous, they've seen it before, it isn't covid that has made people stay at work, it is not knowing when inflation is going to back off.

www.abc.net.au

www.abc.net.au

The average retirement age in Australia is growing. An economist explains why

New analysis from KPMG shows how COVID has pushed more people over 55 back into the workforce, with the retirement age steadily increasing over the past 20 years.