wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,164

- Reactions

- 13,660

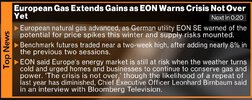

Where to park cash? Like, a lot of cash? ?Meanwhile:

View attachment 160709View attachment 160707

And they even have several others staring down the barrel likely added to the list soon:

View attachment 160708

Remember that recessions are just like nature - the weakest perish first and then down the line we go.

A few months back it was the small banks, now these ones are mid size banks.

Next will be the bigger ones.