over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,470

- Reactions

- 7,932

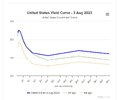

Remember all those posts I made about rates remaining high for longer, basically just hitting a plateau rather than up and then back down in quick succession? And how the yield curve is probably going to deinvert as a result of long duration soaring rather than short duration dropping back down?

The fact that treasury is now selling long duration bonds rather than short duration is very, very telling.

Normally they'd still sell shorter duration in anticipation of the yield curve going back to normal, but the very fact that they're not doing this and are instead selling long duration tells us what they think is going to happen to both rates and the yield curve as a whole.

Normally long duration rates are higher than shorter and so selling long duration is the height of stupidity... Unless the yield curve is inverted (so long duration is actually the cheapest way they can borrow) and they don't think long duration is going to stay where it is much longer