- Joined

- 28 May 2020

- Posts

- 7,029

- Reactions

- 13,650

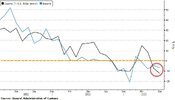

As usual, the BLS get to those figures using "adjustments".View attachment 159538

Markets barely moved in response. Gut instinct says the fed will stick to forward guidance of one more hike and then pause (give it the old "wait and see").

From Zero Hedge

The number of Americans filing for jobless benefits for the first time last week fell to 237k last week (from 249k the prior week) on a seasonally-adjusted basis. Without the 'seasonal adjustment', initial jobless claims rose to its highest since January...