over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,470

- Reactions

- 7,932

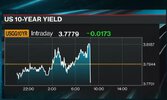

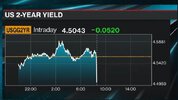

And the data finally turns!

Pause at the next meeting now being priced in, yields all dumped, growth plays all bounced, at what point will recession expectations counteract p/e ratio adjustments?

Probably only when earnings start reporting below expectations. Seems the train's going to continue until something like that derails it and I can't think what else will do it.

Pause at the next meeting now being priced in, yields all dumped, growth plays all bounced, at what point will recession expectations counteract p/e ratio adjustments?

Probably only when earnings start reporting below expectations. Seems the train's going to continue until something like that derails it and I can't think what else will do it.