- Joined

- 14 February 2005

- Posts

- 15,270

- Reactions

- 17,446

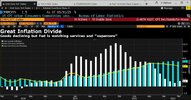

One I can put some figures on is the electricity distribution industry.If you take a look, you'll see that the "core" inflation number is much worse than the rest.

That's the "poles and wires" side of it, not actually generating any electricity at all just distributing it.

SA Power Networks revenue for 2023-24 all inclusive should be $854.425 million, up from $802.728 million in 2022-23. That's an estimate obviously but it's the "official" one not mine personally.

So that's 6.44% inflation of something that's inherently rather stable as a business where the main costs are labour and materials (noting that there's no actual electricity in this budget apart from that used internally in offices etc).

That's a fairly "core" measure in my view, it being the increase in costs for a business that by its very nature is mature, stable and mostly doing the same thing from one year to the next.