over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,350

- Reactions

- 7,662

View attachment 152481

https://www.bloomberg.com/news/arti...?utm_source=google&utm_medium=bd&cmpId=google

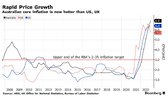

40 basis points on the cards for AU now

Depends what his political masters tell himPhil Lowe was one of the first to signal a pause in 2022... I don't know if he'd have the nads to go for 40bps hike, let alone continue hiking much longer!

Yeah, it's starting to slow down out there pretty fast now. I don't know if Phil can take the heat from destroying the economy.Phil Lowe was one of the first to signal a pause in 2022... I don't know if he'd have the nads to go for 40bps hike, let alone continue hiking much longer!

Alright, markets not giving a f**k now, it's growth and tech led growth full steam ahead - nasdaq's run and SOX have run too but as I showed a few posts back, big tech is where it's at. TQQQ 9%, SOXL 5%, FNGU 19% just on the day.

I've torched GUSH & UDOW, kept hold of NRGU, grabbed a bit more degen FNGU today and kept some cash now primed for a buy tomorrow.

Markets simply do not care at this point.

What was that guy saying about the fed being irrelevant or something???

Big tech reported earnings after hours, almost exactly in line with estimates and then actually sold off a bit.Meme stonks making a come back.

It's risk on, and there's nothing that looks like its about to stop it.

Maybe a double top recession?

So what does the GBP do in response?The Bank of England has once again pushed up interest rates, in the tenth hike in a row.

Seven members of the Bank of England’s Monetary Policy Committee (MPC) voted to increase the base interest rate from 3.5% to 4%, with two voting to keep it unchanged.

The MPC also softened its language, removing a promise to act “forcefully” to return inflation to its target level.

“Looking further ahead, the MPC would adjust the Bank rate as necessary to return inflation to the 2% target sustainably in the medium term, in line with its remit,” the minutes of the meeting said.

in a land of shifting definitions and formulas ...NOThere was a short discussion on the radio yesterday morning. Apologies if already posted or mentioned.

Has high inflation peaked in the US?

The US Federal Reserve's decision to lift interest rates by 25 basis points was widely expected, it's the smallest rate rise in nearly a year.

Justin Wolfers, Professor of Economics and Public Policy told RN Breakfast that he believes the "crisis of high inflation" will soon be over in the US, if its not already.

Guest:Justin Wolfers, Professor of Economics and Public Policy at the University of Michigan

Has high inflation peaked in the US? - ABC listen

The US Federal Reserve's decision to lift interest rates by 25 basis points was widely expected, it's the smallest rate rise in nearly a year. Justin Wolfers, Professor of Economics and Public Policy told RN Breakfast that he believes the "crisis of high inflation" will soon be over in the US...www.abc.net.au

There was a short discussion on the radio yesterday morning. Apologies if already posted or mentioned.

Has high inflation peaked in the US?

The US Federal Reserve's decision to lift interest rates by 25 basis points was widely expected, it's the smallest rate rise in nearly a year.

Justin Wolfers, Professor of Economics and Public Policy told RN Breakfast that he believes the "crisis of high inflation" will soon be over in the US, if its not already.

Guest:Justin Wolfers, Professor of Economics and Public Policy at the University of Michigan

Has high inflation peaked in the US? - ABC listen

The US Federal Reserve's decision to lift interest rates by 25 basis points was widely expected, it's the smallest rate rise in nearly a year. Justin Wolfers, Professor of Economics and Public Policy told RN Breakfast that he believes the "crisis of high inflation" will soon be over in the US...www.abc.net.au

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.