- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

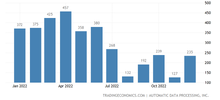

ADP jobs numbers out tonight.

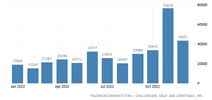

Amazon now planning to shed 18000 jobs instead of the 10000 planned in Nov 2022. Some nice data by LayoffsTracker, we've already had 28000 tech lay offs announced and we're only 5 days into Jan 2023...

Meanwhile, 43 000 jobs cut in December according to this group:

Looks like the unemployment curve is going to start rising soon. Timing seems to be right for a Fed pause based on previous history. Looks like it may be the beginning of the end.

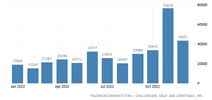

Amazon now planning to shed 18000 jobs instead of the 10000 planned in Nov 2022. Some nice data by LayoffsTracker, we've already had 28000 tech lay offs announced and we're only 5 days into Jan 2023...

Meanwhile, 43 000 jobs cut in December according to this group:

Looks like the unemployment curve is going to start rising soon. Timing seems to be right for a Fed pause based on previous history. Looks like it may be the beginning of the end.