- Joined

- 13 February 2006

- Posts

- 5,379

- Reactions

- 12,481

None of that shows that the other manufacturers are producing vehicles at a more efficient rate than Tesla, and that was/is my original theme.

Your link does go further by giving links to related news proving that the manufacturers had issues producing vehicles, thus not able to sell. And as I mentioned before, Tesla increased its production and sold everything that they produced. Have a look at the last quarter figures.

Produce less = sell less + factory idle time + staff idle time = poor efficiency.

TOKYO (Reuters) - Toyota Motor Corp is slowing production at as many as 11 plants in Japan because of rising COVID-19 infections among its workers and those at parts suppliers, it said on Thursday.

That disruption, which comes amid a shortage of semiconductors that is already forcing it to curb output, could cut production plans this month by about 47,000 vehicles, a Toyota spokesperson said.

Toyota on Tuesday said it expects to fall short of an annual target to build 9 million vehicles because it did not have enough chips. The company's business year ends on March 31.

None of that shows that the other manufacturers are producing vehicles at a more efficient rate than Tesla, and that was/is my original theme.

Your link does go further by giving links to related news proving that the manufacturers had issues producing vehicles, thus not able to sell. And as I mentioned before, Tesla increased its production and sold everything that they produced. Have a look at the last quarter figures.

Produce less = sell less + factory idle time + staff idle time = poor efficiency.

TOKYO (Reuters) - Toyota Motor Corp is slowing production at as many as 11 plants in Japan because of rising COVID-19 infections among its workers and those at parts suppliers, it said on Thursday.

That disruption, which comes amid a shortage of semiconductors that is already forcing it to curb output, could cut production plans this month by about 47,000 vehicles, a Toyota spokesperson said.

Toyota on Tuesday said it expects to fall short of an annual target to build 9 million vehicles because it did not have enough chips. The company's business year ends on March 31.

TM - Toyota Motor Corporation ADR Stock Price and Quote

TM - Toyota Motor Corporation ADR - Stock screener for investors and traders, financial visualizations.finviz.com

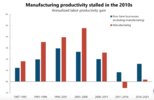

The issue was whether 'productivity' could ameliorate the effects of inflation.

The numbers clearly indicate that TSLA currently cannot.

jog on

duc