- Joined

- 28 May 2020

- Posts

- 7,050

- Reactions

- 13,718

Nice chart, but nothing to do with discussion.

Mick

Nice chart, but nothing to do with discussion.

Nice chart, but nothing to do with discussion.

Mick

The next survey will be interesting when the full affects of the OMICRON outbreak are seen.The unemployment rate has smashed expectations, falling in December to 4.2 per cent, the lowest since the GFC in 2008.

The number of employed increased by 64,800, a monthly change of 0.5 per cent. While the underemployment rate fell 1.9 per cent to 6.6 per cent. The participation rate remained constant at 66.1 per cent.

The positive figures continued the tightening of the Australian labour market, after the rate fell to 4.6 per cent in November. It has raised expectations that the Reserve Bank of Australia will increase the cash rate earlier than anticipated.

Taken in the first two weeks of December, however, the labour force figures didn’t take in the full extent of the Omicron outbreak.

The Australian dollar jumped more than 10 basis points on the news to US72.32c, its highest point in two months.

You suggest Tesla is now building cars faster and at a lower cost to their competitors without actually providing any proof of that statement. I will stick to some data.

If your statement above is true, and looking at the prices charged for the Tesla vehicles versus other vehicles, one would assume that Tesla must be making an absolute killing on their sales margins.

As sptrawler pointed out, revenue does not back up that sales margin call.

So what do we have left to support your statement?

Mick

you forgot the 'extra sting ' ... plus GSTAnother thought on inflation is what for want of a better term I'll call automatic compounding.

Examples:

Councils often use CPI as a basis for rate setting, on the logic that so long as they don't increase rates by more than CPI then they haven't increased them at all in real terms.

Wages in large organisations, especially government, tend to be negotiated for the entire workforce at one and either CPI is a reference point in those negotiations or the outcome includes CPI as a reference for the calculation of increases beyond the first year of the agreement. Eg x% now plus CPI after 12 months and again after 24 months.

Regulated monopolies, for example gas and electricity networks, very commonly use CPI as a reference in the calculation of permitted rate increases.

Things like bus fares, parking fees, fixed rate government charges (eg car registration) tend not to be directly linked to CPI but it does form the basis when a periodic review is done. Whoever's in charge works on the basis that they can hike the price by CPI and, since that's not a "real" increase, they can easily defend doing so.

I've just become aware that in some countries consumer mobile phone and similar contracts commonly include a clause for CPI indexation. So you've signed up to a (say) $50 per month plan but that's automatically annually incremented by CPI and as a customer you're deemed to have agreed to the new rate.

And many more.

The common theme and my underlying point being a positive feedback loop. As CPI increases that of itself automatically triggers, or at least opens the door to, further price rises. The higher CPI goes, the higher will be the increase in those things for which it forms the basis of determining.

I suspect that sort of arrangement was far less common last time inflation was a problem since the basis of price setting was quite different. Years ago manufacturers commonly "recommended" what price shops should sell products at and things like utilities were based on actual costs with or without a fixed profit ratio. CPI wasn't a direct reference in the setting of prices, the statistic itself didn't directly feed in to future prices whereas now it does.

Even the excise tax on petrol automatically goes up with CPI whereas that used to be a purely political decision to change it. The higher CPI goes, the higher petrol goes and that pushes the CPI up. Feedback loop.

"Inflation is a measure of the rate of rising prices of goods and services in an economy."

Advertising is an added expense which must be recovered by charging the consumer a higher retail price. Higher retail prices means that a workers wage buys less, wages need to increase to keep up.

What Causes Inflation? How It's Measured and How to Protect Against It

In this article, we examine the fundamental factors behind inflation, different types of inflation, and who benefits from it.www.investopedia.com

Tesla did make a profit, and not a bad one for a company just about to open two more factories.

And as you mentioned sptrawler, he did say "With regard inflation, legacy car makers are pushing up the price of their ICE vehicles obviously to improve the profit margin to subsidies EV".

ICE vehicle manufacturers are not making a lot of profit on their EVs, some are having to subsidies their EV to make prices competitive.

Inefficiency, another contribution to inflation.

"Electric car maker Tesla has brushed off supply chain issues and the global microchip shortage to report record quarterly sales and profits.

Revenues rose to $13.76bn in the third quarter of the year, up from $8.77bn 12 months earlier.

The company, led by billionaire entrepreneur Elon Musk, posted a net profit of $1.6bn and sold 241,391 cars."

Elon Musk's Tesla reports record sales and profits

The electric car maker recorded its highest quarterly profit of $1.6bn and sold more than 240,000 cars.www.bbc.com

Of course if you bought TSLA stock back in 2015 or earlier and held it till today:

Of course, you are laughing all the way to the bank.

But to the argument of 'productivity', TSLA does not seem to be that far ahead of the industry.

jog on

duc

This definition is simply incorrect. Rising prices (CPI) are the symptom, not the disease.

Excessive currency and credit creation are the cause of the disease (inflation). You can have credit creation for productive assets, whereby the asset can pay for itself + interest, which is the type of inflation which productivity will ameliorate.

But when you have credit creation for consumption...then you get the inflation that drives currency devaluation and debasement. This drives PPI inflationary pressures which bleed into CPI pressures. If continued unabated, this can and will lead into a collapse of the fiat currency, which is a hyper-inflation.

The COVID hand-outs were the classic version of currency/credit creation for consumption worldwide.

Inflation is simply a loss of purchasing power of the currency due to debasement of the currency via credit creation.

jog on

duc

Not 2015 but still laughing.

“But to the argument of 'productivity', TSLA does not seem to be that far ahead of the industry.” Anything is possible, the majors have had a few years to catch up, though taking the chip shortage during 2021 into account your conclusion is lacking evidence. Show me your reasoning and and figures.

"This definition is simply incorrect. Rising prices (CPI) are the symptom, not the disease." I am not sure what you're saying, it could be that I am a bit foggy being a Friday and I've had a very busy week, or you are the foggy one

It has been a long time since my High School Economic Study's, I remember the definition in the same way that my first link describes it and also as the RBA puts it -

"How is Inflation Measured?

Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of those prices. Typically, prices rise over time, but prices can also fall (a situation called deflation).

The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households...."

Inflation and its Measurement | Explainer | Education

This series provides short, concise explanations for various economics topics.www.rba.gov.au

Your memory may well be reliable. Your High School however was deficient in its understanding.

CPI prices measure inflation much the same way as a thermomemeter measures your temperature. It does not however disclose the cause of your fever.

jog on

duc

How is Inflation Measured?

Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of those prices. Typically, prices rise over time, but prices can also fall (a situation called deflation).

The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households.

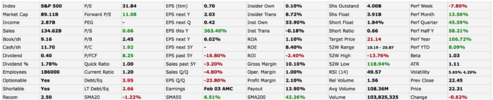

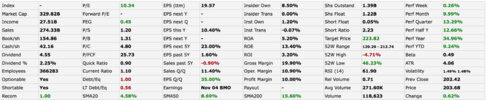

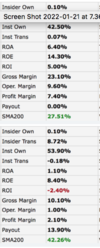

The numbers are already provided, but here they are again:

View attachment 136212View attachment 136213

So in the same order moving L to R: TSLA, F, GM, TM:

jog on

duc

Sorry I still am not understanding your analogy.

Are you saying that the RBA is incorrect?

PS. I did no mention CPI, you have.

Inflation and its Measurement | Explainer | Education

This series provides short, concise explanations for various economics topics.www.rba.gov.au

Sorry but they are just numbers with no reference. Anyone worth half their salt would give some sort of proper information with either

What you have supplied is just a pictures with numerical figures with no dates, no references and your description that we are supposed to take for granted.

- company names linked to the figures, with a source reference or

- a link to the information so as it can be confirmed.

I have seen the figures for the automotive industry ad it does not look good. They are only just starting to ramp up production due to the chip shortage, something that Tesla was able to work around. Tesla vehicle production was at full capacity, they sold everything that they build. No other manufacturer could claim that, many had to shut down lines while they waited on parts.

Average annual wholesale spot prices (calendar years):

Queensland:

2019 = $86.30

2020 = $52.65

2021 = $119.89

Yes, that is exactly what I am saying.

jog on

duc

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.