- Joined

- 20 July 2021

- Posts

- 12,640

- Reactions

- 17,570

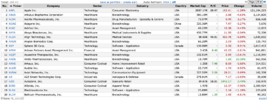

as i was saying in several places , Evergrande is an example , not an outlier

watch out for contagion ( and tighter credit ) in by-gone days the sub-contractors get squeezed first

by the same token , those who like REITs ( and i sure do ) might have some buying times ahead in the next three years ( maybe the regional banks will look more attractive as well )

watch out for contagion ( and tighter credit ) in by-gone days the sub-contractors get squeezed first

by the same token , those who like REITs ( and i sure do ) might have some buying times ahead in the next three years ( maybe the regional banks will look more attractive as well )