- Joined

- 20 December 2021

- Posts

- 218

- Reactions

- 500

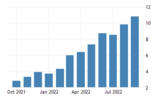

Not great according to the IMF , who cut global growth forecasts to 2.7% next year, and claim that the risk of central bank’s over-tightening has risen sharply. Apart from 2020, which was obviously impacted by strict global lockdowns, this would be the worst year since the GFC in 2009.So what's it going to look like 'post-bubble'?

Of course, this is all speculation, but it definitely isn’t doing much to help with investor sentiment at the moment.