Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

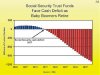

This prediction about the first of the baby boomers withdrawing their funds is made repeatedly. It doesn't make a lot of sense. The baby boomers are going to still require a source of income. To suggest they are going to take all their funds out of the sharemarket takes no regard for how they are gong to derive that income. Aren't they better to still own shares and achieve over time continued growth plus an income stream? Surely better than seeing the funds lose value in a cash account?I tend to agree with the Uncle here, especially this point, but motorway also brings up a valid point. That being the Baby Boomers are setting up for retirement, and will be withdrawing super funds to use for spending.

While I don't believe it will happen at the rate proposed by Robert Kiyosaki, http://en.wikipedia.org/wiki/Robert_Kiyosaki in "Cash Flow Quadrant", there is bound to be a consistant withdrawel all the same, and with the number of X generationers being substantially less than the Baby Boomers, money flowing in is greatly reduced. 2010 should be the start of this phenomenon.

I'm a baby boomer and that's what I will be doing anyway. I don't know anyone who will simply be pulling their funds out on reaching retirement age.