- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Plenty of other companies would have those kind of tonnages up in lights. That and the use of a lot of jargon says to me that these guys seem to be trying to keep a lid on things for the time being

Hey Datsun,

Thats the impression I got speaking to Michael,

He made it clear that he wanted to build a major mining project ie Billions of Tonnes and until he perfected the flow sheet and patended the process he was gonna keep it under tight wraps,

I am amazed at the size of the deposit and its comparable grades to WVL and MOL

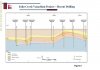

With Vanadium at $80 a kg and Moly at $35/lb the Gross Value of Julia Creek is as follows

High Grade

5 Billion tonnes @ 0.37% V = 18.5M Tonnes @ $80k/t ($80kg) = $1.5Trillion

5 Billion tonnes @ 310g/t Mo = 1.55M Tonnes @ $16k/t ($35/lb) = $24.8 Billion

Clearly the bulk of the In Ground Value is in the Vanadium, but $1.525 Trillion Dollars IGV and thats just the High Grade part is RIDICULOUS, is this Olympic Dam II

The key is making the process work, but even if we heavily discount the value of the project and only allocate a 1% value of the I.G.V., thats still $15Billion in value

Right now I think the mkt is allocating a 0.00000001% Value to Julia Creek, I am checking my I.G.V. figures again, its kinda late and it wouldn't surprise me if I made a mistake