- Joined

- 19 July 2016

- Posts

- 590

- Reactions

- 94

I do. Do you?

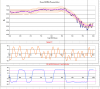

All of those magical CB programs and they couldn't even get to the past highs that were achieved with no QQE, no ETF, no ZIRP, no nothing.

All of those magical programs and still underperformed the global index, an underperformance that only accelerated with ETF purchases and QQE

View attachment 101807

No inflation, no growth, no magical stock "floor".

Almost as if Central Banks aren't even relevant.

buying began 2010 buying accelerated 2013

price only gains

2020 -18.04%

2019 18.20%

2018 -12.08%

2017 19.10%

2016 0.42%

2015 9.07%

2014 7.12%

2013 56.72%

2012 22.94%

2011 -17.34%

2010 -3.01%

10,000 to 18,000 ???

what am i missing ? isn't that 180% gain