- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Yep great post thanks

The availability of these metrics for Aus is really difficult to come by.

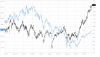

Looking through a different lense:

Question to the forum - how many years until you think we will reach new highs in the All Ords?

Table above is crude but it get's the wheels turning.

The counter to this argument is the Hussman view which even though we have fallen drastically, historically on his model the S&P is no where near cheap

The availability of these metrics for Aus is really difficult to come by.

Looking through a different lense:

Question to the forum - how many years until you think we will reach new highs in the All Ords?

Table above is crude but it get's the wheels turning.

The counter to this argument is the Hussman view which even though we have fallen drastically, historically on his model the S&P is no where near cheap