- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Uncle

So basically most Superannuation is a joke!

Currently 99% of people have no hope in hell of making time let alone getting ahead!

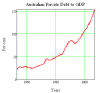

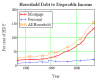

Super has probably been the main game for the last 4 years feeding off itself returning above (real?) inflation so getting ahead in real terms?

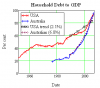

I guess what I was trying to imply was that, yes, the general population has no idea how they are getting fleeced by inflation, and when calculating the returns from any investment, namely real estate here as it applies to stagnating prices, then it should be inflation adjusted?

So apart from Perth & maybe SEQ on average, in inflation adjusted terms, has real estate stagnated since 2004?