- Joined

- 14 April 2011

- Posts

- 371

- Reactions

- 4

I've got a half baked trading scheme that I thought I'd put out there for flammatory comments by experts - who know stacks more than me.

The past few weeks I've been scraping live data to identify some buying opportunities.

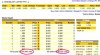

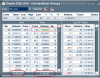

What I've been looking for are stocks with a daily turnover of over $1M with very high buying to selling ratios and following them.

MSB is an example of that - for the past few days at least it's consistantly had roughly 300% more buys than sells, and its steadily rising in price.

The other sort of stocks I look at are those that are bottoming out and at their lowest ever point for some time - CVN, HST and ERA are examples I've identified. As they bottom out the buy/sell ratio is strongly negative. When they bottom out that's when the the ratio turns around. I bought CNV a few days ago at 0.21 - the point that buyers came in - a few days later the ratio is still at about (150%) and the stock has gone up almost 20% - I'll sell it when the ratio goes below zero.

HST bottomed out 29 April and now has very strong ratio (250%) and has gone up roughly 40% and ERA looks to me as if it's still got some time to go before it bottoms out (-30%) - I'll keep watching.

Is this trading scheme totally half baked and idiotic?

The past few weeks I've been scraping live data to identify some buying opportunities.

What I've been looking for are stocks with a daily turnover of over $1M with very high buying to selling ratios and following them.

MSB is an example of that - for the past few days at least it's consistantly had roughly 300% more buys than sells, and its steadily rising in price.

The other sort of stocks I look at are those that are bottoming out and at their lowest ever point for some time - CVN, HST and ERA are examples I've identified. As they bottom out the buy/sell ratio is strongly negative. When they bottom out that's when the the ratio turns around. I bought CNV a few days ago at 0.21 - the point that buyers came in - a few days later the ratio is still at about (150%) and the stock has gone up almost 20% - I'll sell it when the ratio goes below zero.

HST bottomed out 29 April and now has very strong ratio (250%) and has gone up roughly 40% and ERA looks to me as if it's still got some time to go before it bottoms out (-30%) - I'll keep watching.

Is this trading scheme totally half baked and idiotic?