tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,440

- Reactions

- 6,442

Good one tech/a you seem to have a lot of confidence in these waves.

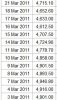

Anyway I bought some ERA yesterday average price $7.46 and some PDN average price $3.44

Almost fully invested.

I use them simply to read where a trade or chart is at in its maturity---bullish or bearish.

I dont want to be filling up a portfolio when it looks like a bearish turning point and Vice versa.

Right now anything Long is in my view very short term.