Sdajii

Sdaji

- Joined

- 13 October 2009

- Posts

- 2,216

- Reactions

- 2,473

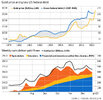

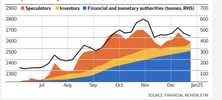

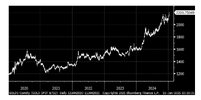

I agree with your sentiments. Also if gold goes to $3000 from $2700 or $2750 which is where FOMO for most will kick in it is only an 8-12% gain which is not as much as we have been used to trading gold on the correct winning side. So it is worthwhile keeping it realistic and remembering the risk v gain equation should this be a plan. I'm not inclined to buy higher atm I must admit but will be interested on a retracement. But then so will everyone else and his dogs. !!!

gg

Haha, you're right about everyone man, his dog, and his dog's fleas being keen to buy on a retrace, which is perhaps going to limit and retrace in the price. If this was a stock price chart I'd be expecting a significant retrace on the way, but this is gold, which is a different beast. Having said that, the different beast has some big players playing some heavy tactics, and every man's dog's fleas, while numerous, don't necessarily have enough capital to deploy to prevent some games from working, and additionally, a percentage of those fleas are fickle and as keen as they may be today, the idiot box may convince them to change their minds quite quickly, while the diehard bugs will already have their fill and don't have infinite funds to continue buying indefinitely.

I assume we both agree on the basic shape of the chart over the next 10 years, but we may not agree on how the next six months will look... well, difficult to disagree with me when I'm uncertain.

It's worth remembering that while gold is larger than small to medium cap ASX-listed companies, governments don't touch most of those companies. And, sure, there are mum and dad investors buying and trading gold in pretty much every country so they're far more numerous, but the governments of pretty much all countries also deal in gold, and governments play by different strategy playbooks from retail.

One good thing about your FOMO strategy of just buying is that in the long run you're definitely going to win on this one - you pretty much can't lose. Congratulations in advance on the appreciation of your gold purchase's value.