explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

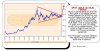

According to Kitco, the high last year was at US$720.10

Cheers,

GP

True, but that was during the session, not a closing price. We await what pans out. Interesting times if one takes an interest, otherwise it probably matters little.

Having said that I am sitting bolt upright