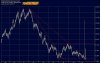

Working on it.For the benefit of the rest of us Jeanie Littles/slow learners, what will the $US, the US dollar index & the gold price do in the next few months?

I have had a couple of conceptual breakthroughs (for me), despite having a range of pressing distractions right now (hence the greatly reduced posting of forecasts), but have been looking at the US dollar equation, coupled with a range of commodities (like gold and the full range of LME futures), and of course the major indices and US bond market.

I know there is a correlation between all of these markets. I know that there is a correlation in daily and weekly time frames (and of course any other time frame including monthly charts).

For me to make a first class forecast now would be premature while I work this out, and incorporate my new concepts into the mix, let alone bounce some ideas off wavepicker and vice versa.

Overall I tend to agree with his perspectives, but have some timing issues to resolve and some interrelationships between various markets to reconcile.

I do have concerns about the state of the China market which is looking very much like a classic bubble (of the “South Sea” and “Tulip” variety).

I think there is a relationship between all these markets to a varying degree which may affect the way gold trends.

I’ll put up some longer term charts to illustrate what I’m struggling with to come to a precise conclusion. Until I can see this clearly, I’m reluctant to make an outright call with a time and price (maybe I’ll make a time only call). I’m waiting on some of the futures data to come in, then I’ll be able to post up some related up to date charts…

Mag