- Joined

- 13 February 2006

- Posts

- 5,222

- Reactions

- 11,987

1. (a) Except that for a comparison to be valid it needs to index each metal from the exact same starting point, and you did not do that. (b) Moreover, ETFs are not spot prices.

2. Choosing a starting point (both time and date) for indexes can significantly affect the ultimate outcomes as if 15 March was chosen instead of the next trading day, then gold would have significantly outperformed silver.

1. (b) Agreed, ETFs are not spot prices, which is why I added the +/-, to demonstrate that these are not exact prices. So you are telling me that the discrepancy is so great that from spot prices that they are materially different? (a) That is true and although on that basis Silver has outperformed Gold by say 2%+/-, the fact still remains that Silver is (-15%) +/- and Gold is +11% +/-

2. Your argument is simply an argument to 'win an argument'. If you look at the big picture, silver is currently underperforming gold. That is a fact. That fact is only important because silver, historically, has not lagged this much for this long. That is a material difference (in my opinion) and I am curious as to why that might be the case. The spread is currently +/- 26%.

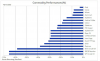

Mr AusTrader mentioned the ratio: You can see when they were both money, their ratio was largely constant. The tiny blips would have been new unexpected supply from newly discovered lands etc.

We have to go back to July-December 1941 = 99.76 ratio (high spike on chart) to find an equivalent value. That was Pearl Harbour territory. Then we have June-July 1991 = 91.04 ratio.

January-June 2009 ratio = 69.85, falling to 42.01 during January-June 2011.

So Mr Rederob, how would you explain the 2009-2011 period? Which from an economic perspective, is very similar: ie. rapidly falling GDP, fast increasing unemployment, debt destruction, etc. This current period is actually even accelerated over the 2008-2009 period as the quarantine of the world happened almost overnight (yes, I exaggerate somewhat).

Yet, Silver, is lagging by (-26%) and showing no real signs of stirring currently.

Is it an issue?

If not, why not?

jog on

duc

.

.