- Joined

- 29 January 2006

- Posts

- 7,222

- Reactions

- 4,453

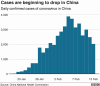

1. The coronavirus has been with us for many weeks now and equities are barely affected, overall. As for bond rates, they came off a 2-month low point at beginning of February, and were actually continuing to decline for over a week after the first cases of coronavirus were reported.1. Not according to the charts. Equities declined (marginally) while Bonds rallied.

2. Why was gold 'due' for a consolidation?

3. Gold didn't correlate to the virus on the upside (expanding/unknown virus risk) why do you expect it to correlate on the downside (falling virus risk etc)?

View attachment 100280

But it correlates very closely to the 20yr Bond (as an example).

The question you should be asking (amongst actually many questions) is:

How low in yield can the highest quality Bond go, which is currently the US 30yr Treasury Bond.

It wouldn't surprise me that it goes to zero (0%).

Will the US go negative (like Europe/Japan)? Possibly.

While rates go lower, Gold will go higher. Rates (furthest out on the curve) have about 3% to zero. How much upside would you calculate for Gold?

jog on

duc

2. Gold pushes to new highs and then consolidates:

3. I do not expect gold to "correlate" with the coronavirus. Instead, I see the virus as a portend of continuing market uncertainty.

As a result, I cannot see there being a meaningful dip in POG as this uncertainty is likely to prevail for weeks and possibly months to come.

While bonds and gold give some clues, the real clue is from accumulating debt. That clue is with us for decades. So gold consolidating above $2000 in a few years time should not be seen as a surprise.