- Joined

- 25 February 2011

- Posts

- 5,690

- Reactions

- 1,235

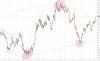

Yeah but, at least we know that next time we see a full moon with the sun in uranus, POG will reach at least 1255 (according to the fibber nachos). Credit where credit is due!That second coming of jesus formation I often see setting up but alas it always fails without any follow through.