- Joined

- 8 April 2008

- Posts

- 871

- Reactions

- 0

Awesome.

The first ever technical analysis that I have found to be comprehensible.

Regulators fine global banks $4.3 billion in currency investigation

(Reuters) - Regulators fined six major banks a total of $4.3 billion for failing to stop traders from trying to manipulate the foreign exchange market, following a yearlong global investigation.

HSBC Holdings Plc, Royal Bank of Scotland Group Plc, JPMorgan Chase & Co, Citigroup Inc, UBS AG and Bank of America Corp all faced penalties resulting from the inquiry, which has put the largely unregulated $5-trillion-a-day market on a tighter leash, accelerated the push to automate trading and ensnared the Bank of England.

Looks like yet another 'conspiracy theory turned fact' event again - one more to the tin foil hat wearers

Still waiting for someone with morals & ethics to bring the PM market manipulators to 'justice'..............or any 'market' for that matter these days?

Ya reckon they always fixed the price down?

Why not,

Come on Unc!! They are sweeping stops a few ticks away. That will be a setup that will depend on the market at the time. So up just as much as down and you would think there was far more stops higher to take out over the last 10 years than lower.

You got to look at this stuff with some common sense. They were not moving gold from $1600 down to $1200. They were moving it a $1 here or there. Thats a market. Always has been.

I think the question is for the gold detractors as to why gold went to $1850 in the first place, having regard for the fundamentals then and now, because if anything the fundamentals for gold are more compelling now than back in say 2001 when it first started to move in earnest. I think it was base fundamentals buying (deep/smart? money) with then a general mainstream momentum trade once it caught on until it exhausted, or The City/Fed decided enough was enough and have driven it lower at convenient times ever since to knock it out technically as per pixel post. Simply unloved/no momentum right now.......gold is patient, waiting for confidence in CB rhetoric to fail.

The problem for TC/F is that it's all getting absorbed by the non $USD cheer squads for bargain basement prices who would love it to go even lower?

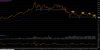

Pixel your chart has so much stuff on it I cannot see what you are talking about.

You got to look at this stuff with some common sense. They were not moving gold from $1600 down to $1200. They were moving it a $1 here or there. Thats a market. Always has been.

There is probably some truth in it but where is the data showing that the The City/Fed hold even 1 contract short in PMs? I mean it is exactly what they were/are trying to engineer, Inflation. So why would they give a toss about it showing up in PMs which are a tiny bit of the equation? I mean think about the logic in that without the Zerohedge conspiracy think. They wouldn't give a toss until it shows up in real wages which is a long long long way away. They have bigger problems.

I think the silver chart shows what is happening. Started as a fundamental trade. Every prepper and two bob crazy rolled into it causing a bubble in the QE=hyper inflation = PM boom trade. As the inflation has failed to show the real money has sold into the preppers and hopeful late Johns. Now we are left with a deflating mess in PMs.

All the gold bugs who like to post bubble charts of Equities and junk as a warning now are in the ironic position of holding something they value dearly that is at the bad end of just such a scenario. Ironic!!

Betting against gold and silver prices has this month reached multi-year records on the latest data from US regulator the CFTC.

Data compiled by Reuters this morning showed open interest in US gold options was heaviest in "put" contracts – set to profit if gold falls – at target prices of $1100-1200 for both December and January.

"The gold price has increasingly become a function of the strength of the US Dollar in recent weeks," says a note from the commodity analysts at Standard Bank, saying that gold is "acting as a pseudo-currency."

"Precious metals," says Sean Corrigan at Diapason Commodities in Switzerland, "are only currently finding support from a bout of physical tightness in gold," as shown by a rising cost to borrow gold through London's wholesale market.

The annualized interest rate on bullion demanded by would-be gold lenders for 1-month swaps has risen since the start of November to 0.27%, steadily reaching the highest level since dramatic spikes to 0.5% and 4% in 2001 and 1999, caused by a rush to cover short positions taken by bearish traders.

"So far," says Bernard Dahdah at French investment and bullion bank Natixis, "rises in lease rates have reflected the difficulty of transforming [large] Western-held bullion bars to kilo bars [for Asian investors].

"But at some point, this may become more a question of the absolute volumes of gold still held in Western vaults."

With London the centre of world bullion dealing, net gold exports from the UK have now totalled 1,680 tonnes since the start of 2013 according to BullionVault analysis.

That equals more than 60% of total net imports – primarily held for investors in London's specialist vaults – over the previous five years.

'a $1

1. Anywho, is there is a fundamental reason for the price to go up or down?

2. The reason I ask is that a few years ago a number of very well respected commentators theorised that the money printing of the Fed, and elsewhere, would create drastic inflation and paper currency would turn the USD into Weimar Republic cash of legend.

But, the money printing hasn't resulted in inflation.

Gold has gone down.

Gold stocks have been decimated.

Has a guarantee of a piece of paper, or a bit coin, replaced hard gold?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.