CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

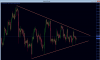

With tonight's initial jobless claims and retail sales due out in 41 minutes, i'm trying to pick which side will get hurt worse when the number prints....if the number prints bad then gold should spike higher into 1300. If the numbers are good then i think a few longs might get wasted....The market is heavy with new longs, most of the shorts have likely covered out now...down would be swift i reckon...