You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 16 June 2009

- Posts

- 387

- Reactions

- 4

...pre-empting pmi/mfi flashes is my guess...but its a guess..... espesh as the volumes are like annoc size

Good guess

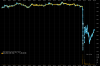

After PMI: (right hand side chart shows the futures volume on a 30min)

Looks like it's still being offered pretty fiercely too

Interesting that gold has been moving correctly before a few of the US announcements recently

- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Cheers for that info UF. What do you think of MMS (Medusa Mining)

MMS & NCM both seem good buys at the moment, trading under book value. They seem good value at these levels. Of course the growth in this will be when commodities take off again which may be a long time coming.

tinhat

Pocket Calculator Operator

- Joined

- 1 May 2009

- Posts

- 1,756

- Reactions

- 769

MML have been a disappointment over the past couple years. So much promise and so much under delivery. Delays to the mine expansion and new mill have meant that they have missed the boat during the boom years. Once they get their new mill running it is going I think the market is going to want to see real hard production figure reports before faith in management is restored. The long term potential is there. They have to deliver. I hold. We may have seen the share price bottom in June. Time will tell. We are talking about a stock that has been in downtrend for two and a half years now so if you are thinking about a long term investment it might be worth waiting until the chart demonstrates it has turned around.

The MML share price was around these levels back in May 2009 and the price of gold then was a touch under $1,000.

The MML share price was around these levels back in May 2009 and the price of gold then was a touch under $1,000.

Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

I might take an interest between $5.00 - $6.00...realistic i.m.o.

- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

pos feedback loop ? ....jewellery retailers sell less = less demand too = deflationary trend = (etc etc)

data SoberLook

https://twitter.com/SoberLook/status/404836154450522114/photo/1

- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

expecting to continue the bounce bias today and tomorrow...event tho we have news releases they'll prob be whips only....just a chance for money to do business both ways

retail traders should size with caution trading this kind of chop

anyways

some articles for anyone new to bullion/pm's

www.washingtonsblog.com/2013/03/gol...ference-call-with-a-handful-of-big-banks.html

http://goldnews.bullionvault.com/gold-fix-112620131

ColinTwiggs says:

May 6, 2013 at 5:18 am EST

"There is no one spot market for gold. The feed we receive provides bid and ask prices from major dealers, as collated by Morningstar in London."

retail traders should size with caution trading this kind of chop

anyways

some articles for anyone new to bullion/pm's

www.washingtonsblog.com/2013/03/gol...ference-call-with-a-handful-of-big-banks.html

http://goldnews.bullionvault.com/gold-fix-112620131

ColinTwiggs says:

May 6, 2013 at 5:18 am EST

"There is no one spot market for gold. The feed we receive provides bid and ask prices from major dealers, as collated by Morningstar in London."

http://goldstocksforex.com/2013/05/05/gold-and-crude-bear-market-rally/Colin Twiggs 060513 said:Gold is testing resistance at $1500. There has been much discussion in the media of strong buying of physical gold, but this is not confirmed by the chart. Gold now presents a strong setup for a short trade. After a reasonable bear market rally, price is now consolidating below resistance at $1500. Breakout below $1450 and the rising trendline would signal another primary decline, testing primary support at $1320 but with a target of $1150*.

- Joined

- 12 February 2012

- Posts

- 410

- Reactions

- 29

http://www.bloomberg.com/news/2013-12-19/g...fed-tapers.html

Gold’s Drop to Lowest Since ’10 Will Extend for Goldman Sachs

My ideas are not a recommendation to either buy or sell any security orcurrency. Please do your own research prior to making any investment decisions.Please note that I do not endorse or take responsibility for material in the above hyper-linked sites.

Gold’s Drop to Lowest Since ’10 Will Extend for Goldman Sachs

My ideas are not a recommendation to either buy or sell any security orcurrency. Please do your own research prior to making any investment decisions.Please note that I do not endorse or take responsibility for material in the above hyper-linked sites.

- Joined

- 12 February 2012

- Posts

- 410

- Reactions

- 29

When "normal people" get in something professionals will get out.

Next 12 to 24 months USD is up. Gold will go down to $600 level. Gold is a commodity like any other commodities and yields zero return. There are a lot of assets out there that can offer and will offer higher yield. Gold has no industrial value whatsoever except for the jewelry Indian market. Gold went up due to pure speculation cash moving from one asset to another on a global scale. Gold isn't an investment it's a pure speculative move. Most gold buyers jumped blindly on gold speculating on "upcoming hyper- inflation. We should not forget that even in the 600s gold will still be 50% higher than in 2004. For mid and long term players it is time to go behind out of favour boring commodities. These types of commodities will have demand in all types of situations. Can anybody postpone eating and drinking in inflationary or non- inflationary environment? Even during war people cannot wait without eating and drinking. They cannot eat gold and silver. What about two children policy in China? One thing I like to mention here. There will be great demand for Australian and New Zealand meat from China in the coming decade. As a commodity meat will shine in the coming decade. Even for kangaroo meat there will have great demand from China.

My ideas are not a recommendation to either buy or sell any security,commodity or currency. Please do your own research prior to making any investment decisions.

Next 12 to 24 months USD is up. Gold will go down to $600 level. Gold is a commodity like any other commodities and yields zero return. There are a lot of assets out there that can offer and will offer higher yield. Gold has no industrial value whatsoever except for the jewelry Indian market. Gold went up due to pure speculation cash moving from one asset to another on a global scale. Gold isn't an investment it's a pure speculative move. Most gold buyers jumped blindly on gold speculating on "upcoming hyper- inflation. We should not forget that even in the 600s gold will still be 50% higher than in 2004. For mid and long term players it is time to go behind out of favour boring commodities. These types of commodities will have demand in all types of situations. Can anybody postpone eating and drinking in inflationary or non- inflationary environment? Even during war people cannot wait without eating and drinking. They cannot eat gold and silver. What about two children policy in China? One thing I like to mention here. There will be great demand for Australian and New Zealand meat from China in the coming decade. As a commodity meat will shine in the coming decade. Even for kangaroo meat there will have great demand from China.

My ideas are not a recommendation to either buy or sell any security,commodity or currency. Please do your own research prior to making any investment decisions.

- Joined

- 17 August 2006

- Posts

- 7,938

- Reactions

- 8,668

When "normal people" get in something professionals will get out.

Next 12 to 24 months USD is up. Gold will go down to $600 level.

I see a few holes in some of your theories M/W

Gold under $1000/oz. will put most Gold producers under water. Long term support at $1030/oz. could get tested, but Supply and Demand would have to balance at some point.

If we get the "Armageddon" you are describing you may be right .... you can't eat Gold, but it would likely buy you a lot more rice bubbles than a pile of iron ore would

Attachments

This from Michael Pento a month ago....26/11/2013 Huff Post Business

The money supply as measured by M2 is now rising at a 12.1 percent annualized rate, which is causing the fickle Fed to renew its threats about ending QE. The minutes released from the latest FOMC meeting indicate the tapering of asset purchases could once again begin within the next few meetings.

Could it be the Fed is finally getting concerned about the asset bubbles it so desired to create? The robust increase in money supply has pushed stock prices higher; you could also throw in diamonds, art, real estate and Bitcoins to name just a few assets that are in raging bull markets. All those items just mentioned are not counted in the CPI measurement and therefore allow most on Wall Street and in D.C. to claim there is no inflation.

But despite promises from the Fed that tapering (when and if it ever comes) isn't tightening monetary policy, the Ten Year Note just isn't a believer. That benchmark yield was trading below 2.70 percent before the FOMC minutes were released, and then shot up to 2.84 percent within 24 hours of learning the taper talk was back on again; clearly illustrating the enormous pent-up pressure on bond yields.

So what you may say? Aren't rising yields a sign of a healthy economy? Perhaps under normal conditions that is true. But in sharp contrast, today's rising yields are the result of the combined forces of inflation and tapering fears. In reality, ending QE is all about the government relinquishing its utter dominance of the bond market.

However, the fear over the imminent end of easy money is for the most part unfounded. And even if the Fed were to curtail QE sometime in the near future, it would only last briefly; and the tightening policy would have to be quickly reversed, as I believe the entire globe would quickly sink into a deflationary depression. Precious metal investors may have to wait until the attempted exit from QE fails before a major, and indeed, record-setting advance can occur.

In addition, the odds are also increasing that Janet Yellen (whom I have dubbed the counterfeiting Queen) will allow asset bubbles to increase to a much greater degree than her predecessor, Ben Bernanke ever did. And that should drag commodities along for a nice ride. After all, the gold market has been busy pricing in the end of QE for multiple quarters. There is a good chance that the beginning of tapering would lead to a reversal of the trade to sell gold ahead of the news. But the major averages have priced in a sustainable recovery on the other side of QE, which will not come to fruition. For the Dow, S&P 500 and NASDAQ the end of QE will be especially painful.

But the truth is the U.S. economy is more addicted to the artificial stimuli provided by the Fed and government than during any other time in our nation's history. Aggregate debt levels, the size of the Fed's balance sheet, the amount of monthly credit creation and the low level of interest rates are all in record territory at the same time. This condition has caused the re-emergence of bond, stock and real estate bubbles all existing concurrently as well.

A unilateral removal of stimulus on the part of the Fed will send the dollar soaring and risk assets plunging -- you could throw in emerging market equities and any other interest rate sensitive investment on planet earth. The Fed is aware of this and that is why it is desperately trying to deceive the market into believing ending QE will not cause interest rates to rise. This is a silly notion. Since QE is all about lowering long-term rates how can it be that ending QE won't cause the opposite to occur? This is why the FOMC minutes released today show that the Fed is debating different tactics to run in conjunction with the taper; such as charging banks interest on excess reserves in an attempt to offset the deflationary forces associated with tapering asset purchases.

Nevertheless, the most important point here is most money managers on Wall Street are convinced this is an economy that is on a sustainable path -- but they are completely wrong. Disappointingly, it is much more probable that the government has brought us out of the Great Recession only to set us up for the Greater Depression, which lies just on the other side of interest rate normalization.

Sadly, the Fed has killed the buy and hold theory of investing for many years to come. Having an investment strategy for both rampant inflation and sharp deflation is now essential at this juncture.

Michael Pento is the President and Founder of Pento Portfolio Strategies and Author of the book "The Coming Bond Market Collapse."

The money supply as measured by M2 is now rising at a 12.1 percent annualized rate, which is causing the fickle Fed to renew its threats about ending QE. The minutes released from the latest FOMC meeting indicate the tapering of asset purchases could once again begin within the next few meetings.

Could it be the Fed is finally getting concerned about the asset bubbles it so desired to create? The robust increase in money supply has pushed stock prices higher; you could also throw in diamonds, art, real estate and Bitcoins to name just a few assets that are in raging bull markets. All those items just mentioned are not counted in the CPI measurement and therefore allow most on Wall Street and in D.C. to claim there is no inflation.

But despite promises from the Fed that tapering (when and if it ever comes) isn't tightening monetary policy, the Ten Year Note just isn't a believer. That benchmark yield was trading below 2.70 percent before the FOMC minutes were released, and then shot up to 2.84 percent within 24 hours of learning the taper talk was back on again; clearly illustrating the enormous pent-up pressure on bond yields.

So what you may say? Aren't rising yields a sign of a healthy economy? Perhaps under normal conditions that is true. But in sharp contrast, today's rising yields are the result of the combined forces of inflation and tapering fears. In reality, ending QE is all about the government relinquishing its utter dominance of the bond market.

However, the fear over the imminent end of easy money is for the most part unfounded. And even if the Fed were to curtail QE sometime in the near future, it would only last briefly; and the tightening policy would have to be quickly reversed, as I believe the entire globe would quickly sink into a deflationary depression. Precious metal investors may have to wait until the attempted exit from QE fails before a major, and indeed, record-setting advance can occur.

In addition, the odds are also increasing that Janet Yellen (whom I have dubbed the counterfeiting Queen) will allow asset bubbles to increase to a much greater degree than her predecessor, Ben Bernanke ever did. And that should drag commodities along for a nice ride. After all, the gold market has been busy pricing in the end of QE for multiple quarters. There is a good chance that the beginning of tapering would lead to a reversal of the trade to sell gold ahead of the news. But the major averages have priced in a sustainable recovery on the other side of QE, which will not come to fruition. For the Dow, S&P 500 and NASDAQ the end of QE will be especially painful.

But the truth is the U.S. economy is more addicted to the artificial stimuli provided by the Fed and government than during any other time in our nation's history. Aggregate debt levels, the size of the Fed's balance sheet, the amount of monthly credit creation and the low level of interest rates are all in record territory at the same time. This condition has caused the re-emergence of bond, stock and real estate bubbles all existing concurrently as well.

A unilateral removal of stimulus on the part of the Fed will send the dollar soaring and risk assets plunging -- you could throw in emerging market equities and any other interest rate sensitive investment on planet earth. The Fed is aware of this and that is why it is desperately trying to deceive the market into believing ending QE will not cause interest rates to rise. This is a silly notion. Since QE is all about lowering long-term rates how can it be that ending QE won't cause the opposite to occur? This is why the FOMC minutes released today show that the Fed is debating different tactics to run in conjunction with the taper; such as charging banks interest on excess reserves in an attempt to offset the deflationary forces associated with tapering asset purchases.

Nevertheless, the most important point here is most money managers on Wall Street are convinced this is an economy that is on a sustainable path -- but they are completely wrong. Disappointingly, it is much more probable that the government has brought us out of the Great Recession only to set us up for the Greater Depression, which lies just on the other side of interest rate normalization.

Sadly, the Fed has killed the buy and hold theory of investing for many years to come. Having an investment strategy for both rampant inflation and sharp deflation is now essential at this juncture.

Michael Pento is the President and Founder of Pento Portfolio Strategies and Author of the book "The Coming Bond Market Collapse."

- Joined

- 12 February 2012

- Posts

- 410

- Reactions

- 29

Stock markets are breaking new high. Dollar doesn’t seem to go down. Consumer spending is looking good. Gold is experiencing its worst year in 32 years. I do expect 52-week lows in precious metals in the near future. With this end of year tax loss selling, I did expect some further declines in the precious metals.

My ideas are not a recommendation to either buy or sell any security, commodity or currency. Please do your own research prior to making any investment decisions.

My ideas are not a recommendation to either buy or sell any security, commodity or currency. Please do your own research prior to making any investment decisions.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

I see a few holes in some of your theories M/W

Gold under $1000/oz. will put most Gold producers under water. Long term support at $1030/oz. could get tested, but Supply and Demand would have to balance at some point.

If we get the "Armageddon" you are describing you may be right .... you can't eat Gold, but it would likely buy you a lot more rice bubbles than a pile of iron ore would

Agree barney and with 10 year US T bond yields crossing above 3% the last few days we may have a scatter in the hen house pretty soon now, or fox skins on the fence.

The huge finance/media mania call we have seen for the last month or two, for gold below US$1,000, has in the past signaled bottoms.

Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

Agree barney and with 10 year US T bond yields crossing above 3% the last few days we may have a scatter in the hen house pretty soon now, or fox skins on the fence.

The huge finance/media mania call we have seen for the last month or two, for gold below US$1,000, has in the past signaled bottoms.

The fundamentals don't interest me but when everybody is bearish and predicting further substantial falls then a bottom will be made. Getting near that point now. Doesn't seem too long ago that people were jumping on at the highs with almost every analyst predicting over 2000. Same thing in reverse!!

- Joined

- 12 February 2012

- Posts

- 410

- Reactions

- 29

Different analysts have different ideas on gold. According to some it is expected to see modest recovery in 2014. On the other hand some are very bearish on gold and it is expected go down as low as around $600. It is very interesting. I believe there could be some bull commodities in 2014. Moreover there are attractive opportunities in global stocks markets including other areas than investing in gold market. It is also expected that USD could become bull currency in 2014 and 2015. It will be the game changer in many ways. I am one of the big bulls for USD and one of the big bears for both AUD and NZD. No commodity will stay high or low for ever. As I said now it is going to be different ball game. It is expected that some sectors are going to benefit lot in the coming years. We could see emerging commodities, stocks and currencies. Have a great 2014.

My ideas are not a recommendation to either buy or sell any security, commodity or currency. Please do your own research prior to making any investment decisions.

My ideas are not a recommendation to either buy or sell any security, commodity or currency. Please do your own research prior to making any investment decisions.

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

Was looking at the 10 year chart over the weekend and noticed the obvious, POG now back to where it should be, back to the long term 10 year trend..if we consider the irrational exuberance of 2011/12 to be just that then its full steam ahead with everything going according to plan.

Based on the above i would think that the miners look to be extraordinary opportunities at current prices.

~

Based on the above i would think that the miners look to be extraordinary opportunities at current prices.

~

Attachments

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Was looking at the 10 year chart over the weekend and noticed the obvious, POG now back to where it should be, back to the long term 10 year trend..if we consider the irrational exuberance of 2011/12 to be just that then its full steam ahead with everything going according to plan.

Over such a large range it might be worth looking at the log scale.

Based on the above i would think that the miners look to be extraordinary opportunities at current prices.

~

This I agree. Some of these stocks are priced as if they will never making money again. But one would need to pick the right stock and size their risk appropriately (as per usual). A quick look across metrics like life of mine, operating costs and balance sheet strength will yield lower-risk candidates than others.

Similar threads

- Replies

- 1

- Views

- 539

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K