You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Perth mint.

Then again if I ever wanted to get my hands on the phisical I would just hold the contracts to expiray and pay a spread of $0.01. Bullion dealers.. LOL

Interesting to see if you would get your physical? Would there be fees to be paid as well ie delivery, minting etc? Have you ever looked at the process of taking delivery?

Interesting to see if you would get your physical? Would there be fees to be paid as well ie delivery, minting etc? Have you ever looked at the process of taking delivery?

Kyle Bass, who is a big player with a good (imho) view, looked into it. Definitely worth watching this as it describes the (approx) OI at COMEX across futs and opts, the difference between the OI vs the amount of deliverable metal (80bn vs 4bn), cost of rolling futs (~90bps/y), etc etc as the perspective of someone who was (until recently) a large spec long in the GC futs and lists the reasons they took delivery:

Mostly because.

a) They want to hold it for a long time. i.e. 'saving' not 'trading'. If you watch the whole talk he says they are holding pretty much nothing but US, EU gov credit and gold. Much like the ECB balance sheet!

b) COMEX is "fractional reserve" (Bass) and the reserve managers at COMEX expect 'price will sort it out' re any mismatch between OI and deliverable.

I believe he also advises the UTexas pension fund (one of the few holding gold), and they took delivery from COMEX too.

Last edited by a moderator:

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Interesting to see if you would get your physical? Would there be fees to be paid as well ie delivery, minting etc? Have you ever looked at the process of taking delivery?

Had a quick look this morning. Couldn't find much info, will look into it and report back.

Delivery for the short side of the contract is to one of these,

http://www.cmegroup.com/trading/metals/gold-depositories.html

The pick up and deliver fee etc. No idea.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Oh just to add to that I do know that my broker does not allow delivery of commodes. So I would have to use another broker.

http://www.interactivebrokers.com/en/p.php?f=deliveryExerciseActions&ib_entity=llc

http://www.interactivebrokers.com/en/p.php?f=deliveryExerciseActions&ib_entity=llc

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Peak AAPL then? Got my shorts on it

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,197

Some interesting reflections on gold of late.

. in the first fifty years of the 1900's for every dollar of debt $5 of GDP was created.

in the last eleven years for every dollar of created debt we have 6 cents of GDP.

. Less than 1% of World financial assets are in gold

http://kingworldnews.com/kingworldn..._to_the_$120_Trillion_of_Additional_Debt.html

On his departure from JPMorgan, Geg Smith had this to say about the recent sell down:-

There were numerous other pundits and traders on the ground indicating the banks actions prior to Smith speaking out.

Just seemed a bit subdued around this patch of late. I have been busy still scrounging more silver but just thought I'd give

. in the first fifty years of the 1900's for every dollar of debt $5 of GDP was created.

in the last eleven years for every dollar of created debt we have 6 cents of GDP.

. Less than 1% of World financial assets are in gold

http://kingworldnews.com/kingworldn..._to_the_$120_Trillion_of_Additional_Debt.html

On his departure from JPMorgan, Geg Smith had this to say about the recent sell down:-

"January is right around the time we started increasing our short positions quite significantly again and this most recent crash in gold and silver during Bernanke’s speech on February 29th is of notable importance, as we along with 4 other major institutions, orchestrated the violent $100 drop in Gold and subsequent drops in silver".

There were numerous other pundits and traders on the ground indicating the banks actions prior to Smith speaking out.

Just seemed a bit subdued around this patch of late. I have been busy still scrounging more silver but just thought I'd give

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

I don't see it breaking below $1600 support, seems quite a strong zone.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,197

I don't see it breaking below $1600 support, seems quite a strong zone.

Agree but in this crazy financial market volatility seems the name of the game and anything is possible.

Have been examining the long term point and figure chart on gold and the bottom of the trend line, which commenced on the low set on the 25th of August 1999 is currently at about US$1390. To show that things are okay with the Presidential election coming up, I would not put it past the system to try and test that point.

Interesting times indeed.

Anyway, off topic, we have the Grand Prix on in Melbourne this weekend which is great to help breed the next generation of hoons so as to keep the plods in a job.

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Can Ben Bernanke be any less subtle about the fact that QE1 & QE2 have failed miserably and that QE3 is 'packed up & ready to go', or am I missing the plot completely? That things are going so good with 'The Recovery' that they see the need for more push priming of consumption from the future? All the while continuing to run $Trillion deficits and no improvement in reducing Federal expenditure with stagnant receipts?

Reminds me of Eruptions hit 1 Way Ticket to the Blues -

Choo choo train

tuckin' down the track

gotta travel on it

never comin' back

ooh got a one way ticket to the blues.

gotta take a trip to lonesome town

gonna stay at heartbreak hotel.

A fool such as I such as I will never

I cry my tears away.

Good for gold, but it just doesn't feel right anymore, not that it was ever such?

Student loans $Trillion Bubble deflating with $80Billion in non conforming loans......

Meanwhile shorts have capitulated, insiders are selling at record rates and the Dow blows off......

And, Sturm, Ruger & Co can't keep up with gun production.........

It's going to be worse than I thought........................

Reminds me of Eruptions hit 1 Way Ticket to the Blues -

Choo choo train

tuckin' down the track

gotta travel on it

never comin' back

ooh got a one way ticket to the blues.

gotta take a trip to lonesome town

gonna stay at heartbreak hotel.

A fool such as I such as I will never

I cry my tears away.

Good for gold, but it just doesn't feel right anymore, not that it was ever such?

Student loans $Trillion Bubble deflating with $80Billion in non conforming loans......

Meanwhile shorts have capitulated, insiders are selling at record rates and the Dow blows off......

And, Sturm, Ruger & Co can't keep up with gun production.........

It's going to be worse than I thought........................

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 391

QE3 is 'packed up & ready to go', or am I missing the plot completely?

Naaah, he's just reaching for his cigarette lighter to help those technical clocken in the buy orders. Sentiments a wonderful thing and a lot cheaper than inflation.

"Boooo. Scarred ya's all short, din I!"

Ooops, nearly forgot, some window dressen to do.

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Naaah, he's just reaching for his cigarette lighter to help those technical clocken in the buy orders. Sentiments a wonderful thing and a lot cheaper than inflation.

"Boooo. Scarred ya's all short, din I!"

Yes, but sooner rather than later he's gonna have to put up or get the truck outa there as the fundamentals like employment get revised back down and they realise there hasn't actually been an economic recovery - merely a money shuffling bubble. Keep on keeping on.........until the $700 TRILLION in global derivatives vaporise?

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 391

Maybe but don't forget employments the backward looking indcator, last to move, he's just using it as an excuse to look like a white bird and keep the peace.

- Joined

- 10 October 2008

- Posts

- 31

- Reactions

- 2

I just want to clear up your comment. Governments and bankers... have input on the forums such as this in relation to talking down GOLD/PMs?

Am I included in this, seeing as I work for Perth Mint which is WA Government owned? But then again, we go around helping people buy gold

And re the buy/sell spreads, they are that wide primarily because we sit at recommended retail premiums on the sell side as we don't want to compete against our own dealers, and we also melt down any non-Perth Mint bar or coin we buyback (which is more costly then just reselling).

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

I posted this 'theory/strategy' many moons ago but now someone has done some number crunching and put it in a chart.

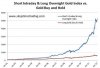

We can easily see the startling difference in the chart below. It compares the results of a simple 'buy and hold' investment in gold over the past ten years vs. a more active (and clever) strategy that both shorts gold during the daily hours and then buys gold long for the overnight session:

http://www.chrismartenson.com/blog/gold-manipulated-thats-okay/72892

Taking advantage of the 'manipulated' market during US trading hours.......Bon Appétit

We can easily see the startling difference in the chart below. It compares the results of a simple 'buy and hold' investment in gold over the past ten years vs. a more active (and clever) strategy that both shorts gold during the daily hours and then buys gold long for the overnight session:

http://www.chrismartenson.com/blog/gold-manipulated-thats-okay/72892

Taking advantage of the 'manipulated' market during US trading hours.......Bon Appétit

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

I posted this 'theory/strategy' many moons ago but now someone has done some number crunching and put it in a chart.

Taking advantage of the 'manipulated' market during US trading hours......

Yes its always manipulation.

Thats the same classic pattern that you see in just about every bull market.

BHP from 2003 -2008,

The spi system during the same time I think returned nearly $300,000 trading just 1 lot!!

Nothing here, just the way most markets move. Unless of course you .......... :alien2:

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Thanks for that TH, sort of visualizes what I've learned about the SPI thru my own testing. I've been trying to find a successful intra day system for the SPI for a week or so, but every attempt leads to the same thing, shorting the open, and covering at the close.....

I've not, until now thought to look at sycom.

Cheers,

CanOz

I've not, until now thought to look at sycom.

Cheers,

CanOz

I posted this 'theory/strategy' many moons ago but now someone has done some number crunching and put it in a chart.

:[/I]

[/I]

Many thanks Uncs. food for thought.

I noticed a few months back when I watched AYN how it predictably fluctuated even intra our trade day. Haven't bothered since though after concentrating on NST and MAD.

It would be nice to be able to sustainably make a $ from workin the system.

cheers.

Similar threads

- Replies

- 1

- Views

- 517

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K