Well

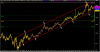

In my view Gold is about to correct.

If I was to trade it it would be short

It would be an "odds against" call for December.

Well

In my view Gold is about to correct.

If I was to trade it it would be short

http://www.bloomberg.com/video/81690186/Nov. 28 (Bloomberg) -- Ned Naylor-Leyland, investment director at Cheviot Asset Management, talks about the outlook for gold prices. He speaks with Francine Lacqua on Bloomberg Television's "On the Move." (Source: Bloomberg)

Gold fast approaching a critical point.

given the long build up of the triangle I believe the breakout will test either 1900 or 1480.

2012 will be a turning point for humanity.

- Euro zone is in recession, attempts to save have failed.

- Flight to $USD's

- Buy gold (transfer cash in bank to physical gold holdings)

- China has a hard landing afterall

- $AU tanks

- AU gold price doubles

- Global recession

- $USD's tank

- US price of gold explodes

- AU gold price doubles, again, & again????

Sounds pretty much in line with my predictions - however I would have thought it would be better to buy USD before EUM collapses, and then switch to gold when USD hits some sort of a peak?

The price of gold has been breaking down

http://www.bespokeinvest.com/thinkb...-to-end-longest-streak-above-200-dmaever.html

:::

"S&P 500/Gold Correlation Spikes"

http://www.bespokeinvest.com/thinkbig/2011/12/14/sp-500gold-correlation-spikes.html

***

The price of gold has been breaking down

http://www.bespokeinvest.com/thinkb...-to-end-longest-streak-above-200-dmaever.html

:::

The price of gold is currently around $1700 an ounce and reports suggest that it will reach more than $2000 an ounce. My broker is suggesting a few gold stocks to me, is it better to go with a junior company in a great region such as VTM or go for a company that is already producing?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.