You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 12 May 2007

- Posts

- 342

- Reactions

- 0

Short term the charts still don't look great to me on the price/volume.. been out of the futures since March 4th due to the volume TH referred to... and then Kauri's hammer (admittedly I didn't predict the correction, but the signs kept me out).

How are others reading this market on the ST?

There is a potential support level at E575-580.

Charts for Newmont, Coeur look pretty horrible, medium term, from a charting perspective.. but the XAU:gold is in firm buying territory at 0.186 so I'm inclined to pay more attention to the excellent fundamentals than to pay too much attention to these charts..

How are others reading this market on the ST?

There is a potential support level at E575-580.

Charts for Newmont, Coeur look pretty horrible, medium term, from a charting perspective.. but the XAU:gold is in firm buying territory at 0.186 so I'm inclined to pay more attention to the excellent fundamentals than to pay too much attention to these charts..

Attachments

- Joined

- 12 May 2007

- Posts

- 342

- Reactions

- 0

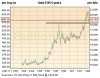

First indicator of trend reversal according to Williams % R based on backtesting, interesting to hear your opinions. Every time this stock has crossed the bottom band after a period of sustained losses , the upward cross has signaled the end of a bear run.

so far twice on the chart - have you backtested this back any further?

Kauri

E/W Learner

- Joined

- 3 September 2005

- Posts

- 3,428

- Reactions

- 11

consumer confidence... expected 73... printed 63... a fillip for gold but not so flash for the S+P????

Cheers

.......Kauri

Cheers

.......Kauri

will be interested to see this indicator back in May 2006 gold crash.so far twice on the chart - have you backtested this back any further?

May 2006 Williams indicator as requested. I have to admit i have done limited backtesting on this however it seems to looks fairly good. Each time it was crossed and continued it has led to atlest a 4% swing. Seems to work better for small short term price swings as July to October was a downtrend, although no indicator is perfect .

Attachments

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,984

- Reactions

- 13,304

Williams% is exactly the same as fast stochastic, just indexed differently.

It measures the closing price in relation the the last x days highest and lowest price. That's it.

It measures the closing price in relation the the last x days highest and lowest price. That's it.

- Joined

- 5 January 2008

- Posts

- 556

- Reactions

- 0

There's a video on the front page of Bloomberg with some bloke talking about the possibility of the Fed fixing the USD. What are people’s thoughts on the likelihood of that happening and what does it mean for the POG?

- Joined

- 31 May 2006

- Posts

- 1,941

- Reactions

- 2

Unless the underlying fundamental situation changes I can't see intervention doing anything but postponing the inevitable - but it could possibly buy enough time to prevent a full collapse and allow them to ride through. Any prolonged intervention will mean there isn't a free and efficient market in the dollar, which means an unregulated parallel "black" market would likely start to appear and the USD would no longer be behaving as a proper currency.

Short term intervention to prop something up at a time when the fundamentals are shifting back into its favour would be a different situation and would potentially help the USD - but the fundamentals would have to change (no more subprime icebergs, no more money printing).

Just reading about the Fed involvement in the Bear Sterns buyout - they are tipping in $29 billion for 10 years at 2.5% - so thats not a 30 day discount window loan to stop a liquidity freeze up - its a direct injection of $29 billion into the system.

Short term intervention to prop something up at a time when the fundamentals are shifting back into its favour would be a different situation and would potentially help the USD - but the fundamentals would have to change (no more subprime icebergs, no more money printing).

Just reading about the Fed involvement in the Bear Sterns buyout - they are tipping in $29 billion for 10 years at 2.5% - so thats not a 30 day discount window loan to stop a liquidity freeze up - its a direct injection of $29 billion into the system.

- Joined

- 12 May 2007

- Posts

- 342

- Reactions

- 0

May 2006 Williams indicator as requested. I have to admit i have done limited backtesting on this however it seems to looks fairly good. Each time it was crossed and continued it has led to atlest a 4% swing. Seems to work better for small short term price swings as July to October was a downtrend, although no indicator is perfect .

Hey, that's not bad - only one false signal I can see there... Wayne can you suggest an improvement?

- Joined

- 12 May 2007

- Posts

- 342

- Reactions

- 0

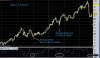

Some of us, me included, use MT4 fed by North Finance for the spot gold and charting, MT is great but I think something's up with the Norths gold feed. Monday it had 8-month support line on the daily at about 890.. on stockcharts it was in the low 900s and so the support was actually tested, I just discovered. Also in early Feb on North feed I got a major trendline breakdown which turned out to be unique to the North data.. tried switching to Orion just now but their volume isn't right.. grateful for any tips on best alternative data feeds for GOLD.

Cheers

1- Stockcharts, 2- North (both daily charts)

Cheers

1- Stockcharts, 2- North (both daily charts)

Attachments

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,984

- Reactions

- 13,304

Hey, that's not bad - only one false signal I can see there... Wayne can you suggest an improvement?

No, just want folks to understand what is being measured and make their own conclusions.

- Joined

- 5 January 2008

- Posts

- 556

- Reactions

- 0

I'm feeling a bit more optimistic than that. The POG has been largely driven by a falling USD and I think the dollar may continue to fall. See video - http://www.ft.com/cms/bfba2c48-5588...html?_i_referralObject=697245262&fromSearch=nGold looking promising at the moment, up to $954.70 peak this morning. I'd expect it to trade sideways between $9.35 and $960 for a few weeks before it tests any resistance levels higher north of this band.

A chart of the USD Index http://quotes.ino.com/chart/?s=NYBOT_DX&v=w

- Joined

- 12 December 2006

- Posts

- 289

- Reactions

- 0

jobless claims and GDP data due tonight in the US so i am hoping Gold breaks into the 960's

http://www.marketwatch.com/news/economy/economic_calendar.asp?siteId=

http://www.marketwatch.com/news/economy/economic_calendar.asp?siteId=

- Joined

- 5 January 2008

- Posts

- 556

- Reactions

- 0

Some interesting reading.

Opportunities arise from gold price plunge

http://compareshares.com.au/zeal38.php

Opportunities arise from gold price plunge

http://compareshares.com.au/zeal38.php

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

- Joined

- 12 December 2006

- Posts

- 289

- Reactions

- 0

please keep posting those charts with volume TH.. i dont get volume on CMC and that's very useful information!!!!!!!!!!!!

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

Would like to see some volume back before I got excited about this rise. Lots of punters with burnt fingers.

However, volume coming in now, after an uptrend is already in place, could signify the weaker hands coming in because they feel they are "missing out". Perfect time for another shake-out. If increased volume comes in, you would want to see the price continue to rise consistently, any sideways or downward movement after one or two up-days, could signify some professional action coming in to force a few more stops. Be especially careful of tight ranges (narrow spreads) with closes in the lower portion.

Similar threads

- Replies

- 1

- Views

- 569

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K