- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

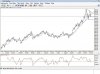

Trade it.

Why didn't you go long at $792 instead of just closing a short? Au is now up $14 from the low in about 5 hours.

If you keep trying to short a bull you'll get your head handed to you. Why not buy the dips and sell on strength, instead of trying to pick tops and sell before it reverses? In a bull market the surprises and biggest moves are always to the upside. Much more chance of profits, and larger ones.

It depends entirely on your goals and trading style RS.

Some here a are short term swing traders who trade the market both ways, move by move, others are happy to hold.

There is no right or wrong way, just different styles. If Trade It is good enough to do it consistantly, then I say good luck to him.

Cheers