chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

The weakness in the US currency has never been at such a low and weak position. When this filters through to a realisation that the present fundamentals indicate that this situation is only going to get worse then gold will rise exponentially. We are near that point.

Back in late 1979 gold went from US$300 an ounce to a peak for a day of $900 an ounce. It settled at an average of $600 for the next twelve months.

Now with the currency situation worse than it was back then we can expect a gold spike the next time to take our breath away.

You may remember a few months ago I posted that the last gold bull multiple, which rose from US $35 oz to $900, was about 25 to one. This bull started at about $270. So currently, in my analysis gold is very, very undervalued at the moment. Bigger players are now going long gold, so any pull back will be small and short lived.

It is interesting, but we tend to believe fiction before fact and there is an old saying that "the truth is stranger than fiction"

In my very humble opinion

The thing that worries me is that gold hasn't broken out against most of the other currencies. It's risen purely on the dollar weakness. So unless you have the ability to access physical gold, trades on gold atm look almost like a red herring. However, if you have the power like a lot of instos obviously do, long term arbitrage gold to currency plays probably look quite attractive now.

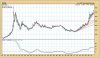

Having said this, there looks to be a great box play forming on the ticker, GOLD. With a target just under $98. However, until the gold price breaks out against the AUD, the results of the local miners are probably going to disappoint...

GOLD box play chart: