DrBourse

If you don't Ask, You don't Get.

- Joined

- 14 January 2010

- Posts

- 919

- Reactions

- 2,242

@Sean KThanks for the advice VC.

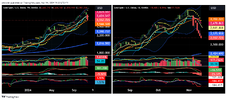

But, I'm talking more about the general gold equities market which should say something about value. The GDX and GDXJ are way off highs and have gone in the opposite direction to gold of late. I've been putting these charts up in the gold thread for a while. There's something more than fundamentals affecting the general gold equities market. My thoughts are that it's not fundamentals, but sentiment. Sentiment will change. Maybe once the Uber drivers start telling us to buy gold. But, by then, most will have missed the boat.

Hi Sean,...

A little bit late, but I've just noticed your 6/3/24 post Nr247 on page 13...

Thought I would add my comments to the discussion....

Technical Analysis, Published Articles and the Internet are the only real Research Tools we have for GOLD and other indicies…

Individual Stocks cannot safely be valued in relation to any INDEX…

There is no such thing as "Financial Factors/Analysis OR Fundamental Factors/Analysis for Gold, Silver, etc, or most Other Indicies"....

That is, there are no Ratios, Margins of Safety, or Balance Sheet Analysis of any kind available to us that would produce what is known as Financial or Fundamental Analysis…

There are, however, outisde influences, such as Soverign Country Manipulation, Economic & Market Forces, Wars, Political Interference, Environmental Risks, Social & Governance Aspects, Production Costs, Inflation, Pandemics, Brokers Analysis, Announcements, Press Releases, Adverse Weather Events, Ramping, Inuendos, Speculation, Fear & FOMO (Fear of Missing Out), Chat Room Posts, and other misleading information that we can access to help evaluate the likes of Commoddities/Indicies etc....

(There are bound to be some others I have omitted or can't remember...)

SO, IMO, the only real "Research Tool" we have, is our knowledge of Technical Analysis (TA), and any other published information we can obtain from trusted sources.…

Cheers...

DrB.