- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

https://www.tradingfloorchat.com/room/5-stock-chat

today has been a good day to follow the money .....liquidity rotations

Joules MM1

2016-Oct-21 01:07:55

and i'm short

Joules MM1

2016-Oct-21 01:07:39

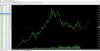

wow, someone leaned on gold

Joules MM1

2016-Oct-21 01:06:34

gold may be on a return journey on a break of 1267's .....least ways i'll sell to open there

today has been a good day to follow the money .....liquidity rotations

Joules MM1

2016-Oct-21 01:07:55

and i'm short

Joules MM1

2016-Oct-21 01:07:39

wow, someone leaned on gold

Joules MM1

2016-Oct-21 01:06:34

gold may be on a return journey on a break of 1267's .....least ways i'll sell to open there