- Joined

- 13 February 2006

- Posts

- 5,168

- Reactions

- 11,849

So we close off January and start Feb.

Tariffs:

New data today gives the best snapshot yet of where economic conditions stand before a potential continentwide trade war.

Why it matters: If tariffs prove disruptive to growth, the U.S. is starting from a position of strength — unlike other major economies — which might cushion the blow of tariffs better than otherwise would have been the case.

On yesterday's GDP number:

LOL. Strongest economy ever.

Oil:

Oil prices are set to finish this week some $2 per barrel lower than a week ago as the January ICE Brent futures contract expires just below $77 per barrel. However, the second straight weekly decline could be cut short very quickly if Donald Trump’s February 1 deadline for Canada and Mexico leads to the US slapping punitive 25% sanctions. If the threat does become a reality, the oil bulls will not stop until Brent is back above $80 per barrel.

Former IEA Employees Turn Against It. Just as the International Energy Agency came under severe criticism from Donald Trump due to its marked focus on climate change, a new report penned by the IEA’s former head of analysis identified 23 false assumptions in the organization’s peak-demand scenarios.

Investments into Clean Energy Hit New Record. According to BloombergNEF, global investment in low-carbon energy reached $2.1 trillion for the first time on record in 2024, but the 11% year-over-year growth is slower than 25% previously and only 37% of what is required to meet net zero emissions by 2050.

Coffee Is The New Cocoa of 2025. Prices of arabica coffee continued to hit record highs this week as front-month ICE futures hit $3.74 per pound on Thursday, on the back of drought-hit tight supplies from Brazil and low coffee bean inventories from top roasters such as Nestle (SWX:NESN) or JDE Peet’s.

UK Says No to Oil Development. The Scottish Court of Sessions ruled that government approval for the Rosebank oil field and Jackdaw gas field was unlawful as it did not take into consideration Scope 3 emissions, indefinitely blocking the United Kingdom’s two largest oil and gas projects.

Ukraine Claims Huge Hit on Russian Refinery. Ukraine’s military struck Russia’s fourth largest refinery in Nizhny Novgorod in an overnight drone attack, causing a large fire and halting operations at the 340,000 b/d refinery’s integrated petrochemical plant, allegedly also attempting a drone strike on a nuclear reactor.

Japan Eyes Alaska LNG to Appease Trump. Japan is mulling support for the $44 billion Alaska LNG project in order to forestall potential trade friction with the United States, eyeing liquefied gas supplies from the port of Nikiski that would be connected to gas fields in the north of Alaska via an 800-mile pipeline.

Appetite for Wind Energy Has Never Been Thinner. UK-based energy major Shell (LON:SHEL) reported a $1 billion write-down on its sole remaining offshore wind energy venture, the Atlantic Shores project jointly developed with EDF Renewables, eyeing 2.8 GW of generation capacity in offshore New Jersey.

Iraq Claims Huge Flaring Breakthrough. Historically one of the worst flarers globally, Iraq claims to have cut the amount of natural gas it releases by 70% after partnering with TotalEnergies and Baker Hughes, with 2023 flare volumes as high as 637 BCf and almost identical to the country’s gas consumption.

Trump Cabinet Moves to Repeal Biden Fuel Standards. The new US Transportation Secretary Sean Duffy directed US regulators to rescind President Biden’s landmark fuel economy standards, hiking CAFE requirements for light-duty vehicles to 50.4 miles per gallon by 2031 from 39.1 miles per gallon now.

Kazakhstan Sticks to OPEC+ Balancing Act. Under pressure from Chevron (NYSE:CVX) ramping up production at its giant Tengiz field to 800,000 b/d, the government of Kazakhstan claimed it would make a final decision on OPEC+ production cut compliance after the next joint OPEC+ meeting in June.

US Oil Majors Double Down on Gas Generation. US oil major Chevron (NYSE:CVX) announced it plans to build natural gas-fuelled power plants next to data centers in the US Southeast, Midwest and East, partnering with investment firm Engine 1 and using gas turbines made by GE Vernova (NYSE:GEV).

Norway’s Government Collapses over Clean Energy. Norway’s government has collapsed after the ruling Labour Party pushed to implement EU clean energy directives, only to see the Centre Party pull out of the coalition and 8 out of 20 government ministers resign, including the finance and defense ministers.

Calcasieu Pass LNG to Start in March. According to US energy regulator FERC, the remaining construction work at Venture Global’s (NYSE:VG) 12.4 mtpa Calcasieu Pass LNG facility will be finalized by the end of February, paving the way for a full start of operations after a two-year regulatory limbo.

European Banks:

No matter how they try, sometimes central bankers can’t avoid creating an event. That’s what just happened to the European Central Bank, which announced a 25-basis-point cut in its policy rate Thursday, as was universally expected. President Christine Lagarde studiously declined to create news during her press conference. But the announcement came on a morning that also saw utterly lackluster GDP numbers in Germany and the euro zone. There are worries about the fiscal deficits in several European countries, led by France, which would normally push yields upward. But slow growth has convinced investors that the ECB is going to have to keep cutting, and so yields took a tumble:

If sentiment moved toward more rate cuts on the day, however, that is against the direction of travel this month. On Dec. 31, there was some confidence that the ECB’s policy rate would be below 2% by the year’s end. Now, it’s seen as unlikely to go beyond that level:

In part, this reflects the global trend. Ever since last October, when markets grew confident that Donald Trump would return to the White House, yields in the US have risen far faster. That in turn puts more pressure on the euro. Last September, the consensus was that the fed funds rate would be one percentage point above that of the ECB by the middle of this year. That has now risen to two percentage points:

The critical question now is to identify the neutral rate, known in the jargon as r*, at which policy is neither restrictive nor accommodative. Lagarde said that ECB monetary policy remained restrictive, but Alberto Gallo, chief investment officer of Andromeda Capital Management in London, listed a series of metrics that suggest conditions are already easy. The ECB’s own quarterly survey of bank lending officers, published earlier this week, suggests as much. Bloomberg Economics’ composite measure of the 12 components in the survey, which is positive when conditions are easy and negative when they are tighter, shows that banks grew more conservative during the last quarter in response to the growing political uncertainty around Trump 2.0. But conditions in the banking system — more important in Europe than in the US where many companies rely on bond finance — remain looser than for most of the time since the Global Financial Crisis began in 2007:

Bond finance also suggests that conditions are easy. The spread on European corporate debt compared to equivalent Treasuries is now, according to Bloomberg indexes, at its lowest since 2021, when the major central banks started hiking:

Another sign of growing resilience comes from banking stocks. Brutalized by the GFC and by the euro-zone sovereign debt crisis that followed, they remain far below their highs. But they are on a good run, and are now at their highest since 2012. The region looks far more resilient against a crisis than it did then, even if it’s hard to get excited about growth. Conditions don’t look tight:

After the market closed, Bloomberg published a story sourced to ECB officials, saying that the central bank was ready to admit that conditions were no longer restrictive at its next meeting in March. But Davide Oneglia of TS Lombard suggests that the arguments over the neutral rate were a distraction:

TSLA

Today's Chart of the Day was shared by Ricardo Sarraf (@nullcharts).

META

he year ahead for MetaMETA $690.78 (0.55%) is all about AI. But the year after that will be all about monetizing it.

The company is currently training Llama 4, the next iteration of its large language model, which it expects to release this year. Even though Llama is a free, open-source product, it sits right at the center of Meta’s plans for growth.

Unlike its competitors in the AI horserace, like OpenAI and Anthropic, Meta can pour tens of billions of profits from its other businesses into this effort (and the infrastructure needed to run it), and has lots of ways that it can turn the free product into a revenue firehose.

On yesterday’s Q4 earnings call, Meta CEO Mark Zuckerberg said:

Meta is an advertising company, after all. For all of FY 2024, the company pulled in over $160 billion in ad revenue, growing 21% year over year.

Zuckerberg regularly says that Meta’s pattern is to grow a product to 1 billion users, then monetize:

And if Meta’s plans for monetizing AI look anything like its current ad business, you might not even have to use Meta’s chatbot to help fuel the new business.

The Meta tracking “pixel” has turned billions of internet users into targets for Meta advertising, even if they aren’t users of Meta platforms. The Meta pixel has become such a built-in default on billions of websites that it has caused sensitive data collection from suicide hotlines, hospitals, tax-filing companies, and federal student loan providers. Dozens of lawsuits have been filed due to the ad technology’s misuse.

Nobody really knows exactly how the “personalization” of AI services will be monetized, but after spending hundreds of billions to build all this fancy, city-sized AI infrastructure, you better believe they will want a return on their investment.

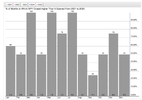

January:

1 day (top)

1 month (below)

jog on

duc

Tariffs:

New data today gives the best snapshot yet of where economic conditions stand before a potential continentwide trade war.

Why it matters: If tariffs prove disruptive to growth, the U.S. is starting from a position of strength — unlike other major economies — which might cushion the blow of tariffs better than otherwise would have been the case.

- The risk, however, is an interruption of Americans' economic gains in recent years, while making inflation a longer-term feature of the economy.

- For the third month, the core Personal Consumption Expenditures Price Index — which strips out food and energy prices and is closely monitored by the Federal Reserve — didn't budge.

- It rose 2.8% in the 12 months through December, above the Fed's 2% target.

- By a different measure, however, inflation looks more benign: Core PCE rose 2.2% on an annualized basis in the previous three months, down from 2.6% in November.

- Still, that jump outpaced the rise in incomes: The personal saving rate was 3.8%, down 0.3 percentage point from November and the lowest level in two years.

- Fed chair Jerome Powell said at a news conference earlier this week that might play a role in how tariffs land on the economy and whether they result in price hikes.

- "There are lots of places where that price increase from the tariff can show up between the manufacturer and the consumer," he added. "Just so many variables."

- Bowman raised the possibility that interest rates might not be high enough to restrict the economy and cool inflation.

- "In light of the ongoing strength in the economy and with equity prices substantially higher than a year ago, it seems unlikely that the overall level of interest rates and borrowing costs are exerting meaningful restraint," Bowman said.

- Trump told reporters in the Oval Office yesterday that he plans to move forward with 25% tariffs on Mexico and Canada. It's unclear whether they will go into effect right away or exclude any imports.

- Canadian Prime Minister Justin Trudeau says the nation will hit back.

On yesterday's GDP number:

LOL. Strongest economy ever.

Oil:

Oil prices are set to finish this week some $2 per barrel lower than a week ago as the January ICE Brent futures contract expires just below $77 per barrel. However, the second straight weekly decline could be cut short very quickly if Donald Trump’s February 1 deadline for Canada and Mexico leads to the US slapping punitive 25% sanctions. If the threat does become a reality, the oil bulls will not stop until Brent is back above $80 per barrel.

Former IEA Employees Turn Against It. Just as the International Energy Agency came under severe criticism from Donald Trump due to its marked focus on climate change, a new report penned by the IEA’s former head of analysis identified 23 false assumptions in the organization’s peak-demand scenarios.

Investments into Clean Energy Hit New Record. According to BloombergNEF, global investment in low-carbon energy reached $2.1 trillion for the first time on record in 2024, but the 11% year-over-year growth is slower than 25% previously and only 37% of what is required to meet net zero emissions by 2050.

Coffee Is The New Cocoa of 2025. Prices of arabica coffee continued to hit record highs this week as front-month ICE futures hit $3.74 per pound on Thursday, on the back of drought-hit tight supplies from Brazil and low coffee bean inventories from top roasters such as Nestle (SWX:NESN) or JDE Peet’s.

UK Says No to Oil Development. The Scottish Court of Sessions ruled that government approval for the Rosebank oil field and Jackdaw gas field was unlawful as it did not take into consideration Scope 3 emissions, indefinitely blocking the United Kingdom’s two largest oil and gas projects.

Ukraine Claims Huge Hit on Russian Refinery. Ukraine’s military struck Russia’s fourth largest refinery in Nizhny Novgorod in an overnight drone attack, causing a large fire and halting operations at the 340,000 b/d refinery’s integrated petrochemical plant, allegedly also attempting a drone strike on a nuclear reactor.

Japan Eyes Alaska LNG to Appease Trump. Japan is mulling support for the $44 billion Alaska LNG project in order to forestall potential trade friction with the United States, eyeing liquefied gas supplies from the port of Nikiski that would be connected to gas fields in the north of Alaska via an 800-mile pipeline.

Appetite for Wind Energy Has Never Been Thinner. UK-based energy major Shell (LON:SHEL) reported a $1 billion write-down on its sole remaining offshore wind energy venture, the Atlantic Shores project jointly developed with EDF Renewables, eyeing 2.8 GW of generation capacity in offshore New Jersey.

Iraq Claims Huge Flaring Breakthrough. Historically one of the worst flarers globally, Iraq claims to have cut the amount of natural gas it releases by 70% after partnering with TotalEnergies and Baker Hughes, with 2023 flare volumes as high as 637 BCf and almost identical to the country’s gas consumption.

Trump Cabinet Moves to Repeal Biden Fuel Standards. The new US Transportation Secretary Sean Duffy directed US regulators to rescind President Biden’s landmark fuel economy standards, hiking CAFE requirements for light-duty vehicles to 50.4 miles per gallon by 2031 from 39.1 miles per gallon now.

Kazakhstan Sticks to OPEC+ Balancing Act. Under pressure from Chevron (NYSE:CVX) ramping up production at its giant Tengiz field to 800,000 b/d, the government of Kazakhstan claimed it would make a final decision on OPEC+ production cut compliance after the next joint OPEC+ meeting in June.

US Oil Majors Double Down on Gas Generation. US oil major Chevron (NYSE:CVX) announced it plans to build natural gas-fuelled power plants next to data centers in the US Southeast, Midwest and East, partnering with investment firm Engine 1 and using gas turbines made by GE Vernova (NYSE:GEV).

Norway’s Government Collapses over Clean Energy. Norway’s government has collapsed after the ruling Labour Party pushed to implement EU clean energy directives, only to see the Centre Party pull out of the coalition and 8 out of 20 government ministers resign, including the finance and defense ministers.

Calcasieu Pass LNG to Start in March. According to US energy regulator FERC, the remaining construction work at Venture Global’s (NYSE:VG) 12.4 mtpa Calcasieu Pass LNG facility will be finalized by the end of February, paving the way for a full start of operations after a two-year regulatory limbo.

European Banks:

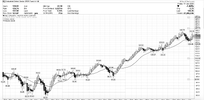

No matter how they try, sometimes central bankers can’t avoid creating an event. That’s what just happened to the European Central Bank, which announced a 25-basis-point cut in its policy rate Thursday, as was universally expected. President Christine Lagarde studiously declined to create news during her press conference. But the announcement came on a morning that also saw utterly lackluster GDP numbers in Germany and the euro zone. There are worries about the fiscal deficits in several European countries, led by France, which would normally push yields upward. But slow growth has convinced investors that the ECB is going to have to keep cutting, and so yields took a tumble:

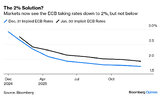

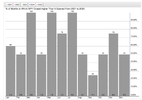

If sentiment moved toward more rate cuts on the day, however, that is against the direction of travel this month. On Dec. 31, there was some confidence that the ECB’s policy rate would be below 2% by the year’s end. Now, it’s seen as unlikely to go beyond that level:

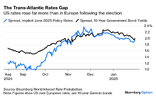

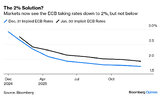

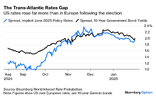

In part, this reflects the global trend. Ever since last October, when markets grew confident that Donald Trump would return to the White House, yields in the US have risen far faster. That in turn puts more pressure on the euro. Last September, the consensus was that the fed funds rate would be one percentage point above that of the ECB by the middle of this year. That has now risen to two percentage points:

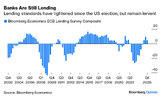

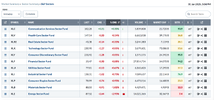

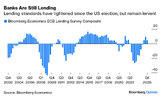

The critical question now is to identify the neutral rate, known in the jargon as r*, at which policy is neither restrictive nor accommodative. Lagarde said that ECB monetary policy remained restrictive, but Alberto Gallo, chief investment officer of Andromeda Capital Management in London, listed a series of metrics that suggest conditions are already easy. The ECB’s own quarterly survey of bank lending officers, published earlier this week, suggests as much. Bloomberg Economics’ composite measure of the 12 components in the survey, which is positive when conditions are easy and negative when they are tighter, shows that banks grew more conservative during the last quarter in response to the growing political uncertainty around Trump 2.0. But conditions in the banking system — more important in Europe than in the US where many companies rely on bond finance — remain looser than for most of the time since the Global Financial Crisis began in 2007:

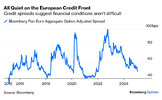

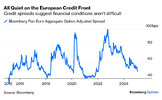

Bond finance also suggests that conditions are easy. The spread on European corporate debt compared to equivalent Treasuries is now, according to Bloomberg indexes, at its lowest since 2021, when the major central banks started hiking:

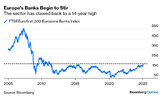

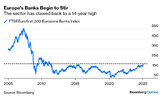

Another sign of growing resilience comes from banking stocks. Brutalized by the GFC and by the euro-zone sovereign debt crisis that followed, they remain far below their highs. But they are on a good run, and are now at their highest since 2012. The region looks far more resilient against a crisis than it did then, even if it’s hard to get excited about growth. Conditions don’t look tight:

After the market closed, Bloomberg published a story sourced to ECB officials, saying that the central bank was ready to admit that conditions were no longer restrictive at its next meeting in March. But Davide Oneglia of TS Lombard suggests that the arguments over the neutral rate were a distraction:

Increasingly, market players believe the slow economy and falling inflation will leave the central bank with no alternative but to cut well below neutral. That will ultimately be good for European risk assets. Oneglia suggests that the ECB should call the recent rise in long-term real yields an “unwarranted, US-driven tightening” of euro-zone financial conditions. If it’s squeamish about cutting rates below neutral, it can always blame the US.Lagarde also made a key point that is always lost on pundits but strengthens our view that this whole r-star debate is mostly a smokescreen: Any estimate of the neutral rate is not “a destination” for rates. The real debate remains if the ECB should turn accommodative and fine-tuning is hard.

TSLA

Today's Chart of the Day was shared by Ricardo Sarraf (@nullcharts).

- Tesla Inc. ($TSLA) rose +2.9% today despite missing earnings estimates last night. It traded lower at one point this morning before reversing higher and closing above $400.

- The stock emerged from a three-year base in December after clearing its 2021 peak at $400. Since then, it has coiled into a Triangle pattern, setting the stage for a large move in the coming weeks.

- If $TSLA resolves higher from this consolidation pattern, the next upside target is $600, representing the 161.8% Fibonacci extension of the base.

META

he year ahead for MetaMETA $690.78 (0.55%) is all about AI. But the year after that will be all about monetizing it.

The company is currently training Llama 4, the next iteration of its large language model, which it expects to release this year. Even though Llama is a free, open-source product, it sits right at the center of Meta’s plans for growth.

Unlike its competitors in the AI horserace, like OpenAI and Anthropic, Meta can pour tens of billions of profits from its other businesses into this effort (and the infrastructure needed to run it), and has lots of ways that it can turn the free product into a revenue firehose.

On yesterday’s Q4 earnings call, Meta CEO Mark Zuckerberg said:

Anytime you hear the word “personalization” in a Big Tech product, that means it will be used for ads. None of the big AI players have integrated ads into their chatbot products, but if anyone is prepared for this, it’s Meta.“We have a really exciting roadmap for this year with a unique vision focused on personalization. We believe that people don’t all want to use the same AI — people want their AI to be personalized to their context, their interests, their personality, their culture, and how they think about the world.”

Meta is an advertising company, after all. For all of FY 2024, the company pulled in over $160 billion in ad revenue, growing 21% year over year.

Zuckerberg regularly says that Meta’s pattern is to grow a product to 1 billion users, then monetize:

But Zuckerberg cautioned that the “actual business opportunity for Meta AI and AI Studio and business agents and people interacting with these AIs” won’t show up until after 2025.“We try to scale them to reach usually a billion people or more. And it’s at that point once they’re at scale that we really start focusing on monetization. So sometimes we’ll experiment with monetization before — we’re running some experiments with Threads now for example.”

And if Meta’s plans for monetizing AI look anything like its current ad business, you might not even have to use Meta’s chatbot to help fuel the new business.

The Meta tracking “pixel” has turned billions of internet users into targets for Meta advertising, even if they aren’t users of Meta platforms. The Meta pixel has become such a built-in default on billions of websites that it has caused sensitive data collection from suicide hotlines, hospitals, tax-filing companies, and federal student loan providers. Dozens of lawsuits have been filed due to the ad technology’s misuse.

Nobody really knows exactly how the “personalization” of AI services will be monetized, but after spending hundreds of billions to build all this fancy, city-sized AI infrastructure, you better believe they will want a return on their investment.

January:

1 day (top)

1 month (below)

jog on

duc