- Joined

- 13 February 2006

- Posts

- 5,056

- Reactions

- 11,454

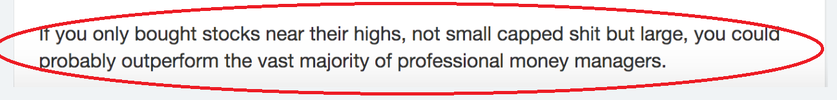

Shocking internets today:

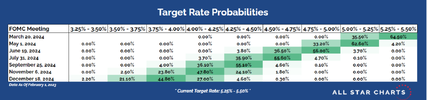

Market puked after Fed says no rate cuts in March.

Mr fff:

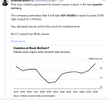

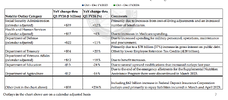

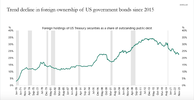

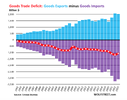

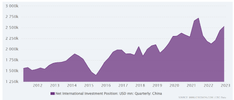

The (immediately) above chart is the China NIIP position.

With China moving to support it's asset prices, a selldown of US assets to repatriate money will puch UST rates higher.

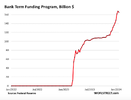

As always, keep any eye on the bond market, especially its liquidity.

jog on

duc

Market puked after Fed says no rate cuts in March.

Mr fff:

The (immediately) above chart is the China NIIP position.

With China moving to support it's asset prices, a selldown of US assets to repatriate money will puch UST rates higher.

As always, keep any eye on the bond market, especially its liquidity.

jog on

duc