MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

G'day all,

Hope the markets are treating you well.

Being a person to try and take something positive from a bad experience I've been reviewing how my systems performed during the COVID March sell off to see if there is anything I could do to improve my system performance for similar future events. I live trade several different system but the one that troubled me the most during the March sell off was my weekly system. Because of the rapid downturn in March my weekly system experience some very significant drawdown that didn't sit well with my risk profile. The thing about the March downturn was that it was extremely rapid and deep and XAO has not seen anything like that before (at least over the 25 years of historic data that I use)--even the 2008 sell off was pretty slow compared to the March COVID sell off. Of all of the back testing I've done on my weekly system it had never been subjected to the conditions we experienced back in March of this year because XAO hadn't behaved like this before. So, with this in mind I set about augmenting my weekly system with an "emergency exit" that would dump all open positions if there is a significant and rapid downturn in XAO. To do this may not suit everybody but it suits my personal trading style.

A little about my weekly system: first it is not the Radge WTT but it is vaguely related to that. What is relevant for this post is that my weekly system uses a similar index filter and a similar stop loss strategy. For those not familiar with the WTT the index filter is only used to prevent new positions from being entered if XAO is in a down trend and the stop losses are used to exit open positions when the close drops below the stop loss. I wanted an additional exit of all positions if the market was experiencing a rapid downturn.

The below images represent the current simulation behavior of my system that I have been using since 2015 and live traded through March--AB simulation results.

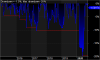

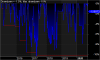

You can see in the below equity chart that there was a nasty drawdown in early 2020. Mentally this was very tough for me to live trade through.

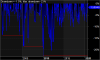

The drawdown is shown in the below drawdown chart in which the portfolio experience around a 20% drawdown.

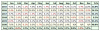

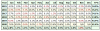

And the below chart chart shows the simulation performance of my system since 2015

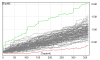

And finally the below chart shows the Monte Carlo simulation results for my system

So as I mentioned earlier, having live traded my weekly system through March the one aspect of my weekly system I wanted to improve was for it to completely exit all positions in extreme downturns (an emergency exit) like we lived through in March. While I've been experimenting with a number of different emergency exits I binned a lot of the techniques I was working on because they became too complicated and convoluted. I'm a firm believer in KISS when it comes to systems so through some trial and error I landed on an emergency exit that simply sold all open positions if for any given week the close of the XAO index was 4.5% down on the open for the week. After running some simulation...wow, what a difference. The system would now deal with a March downturn in a way that is much better suited to my trading style.

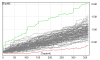

The below images are the performance of my system with the new emergency exit. I'm pretty happy with the improved performance and will include in my live system after I do a few more simulations.

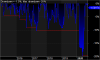

The below equity chart clearly shows that the significant drawdown in early 2020 has been greatly reduced.

The reduced drawdown is shown in the below drawdown chart and the COVID drawdown is only around 8% compared to the above standard system that experienced around a 20% drawdown.

The overall system performance since 2015 is shown below

And finally the overall Monte Carlo simulations are below

Hope the markets are treating you well.

Being a person to try and take something positive from a bad experience I've been reviewing how my systems performed during the COVID March sell off to see if there is anything I could do to improve my system performance for similar future events. I live trade several different system but the one that troubled me the most during the March sell off was my weekly system. Because of the rapid downturn in March my weekly system experience some very significant drawdown that didn't sit well with my risk profile. The thing about the March downturn was that it was extremely rapid and deep and XAO has not seen anything like that before (at least over the 25 years of historic data that I use)--even the 2008 sell off was pretty slow compared to the March COVID sell off. Of all of the back testing I've done on my weekly system it had never been subjected to the conditions we experienced back in March of this year because XAO hadn't behaved like this before. So, with this in mind I set about augmenting my weekly system with an "emergency exit" that would dump all open positions if there is a significant and rapid downturn in XAO. To do this may not suit everybody but it suits my personal trading style.

A little about my weekly system: first it is not the Radge WTT but it is vaguely related to that. What is relevant for this post is that my weekly system uses a similar index filter and a similar stop loss strategy. For those not familiar with the WTT the index filter is only used to prevent new positions from being entered if XAO is in a down trend and the stop losses are used to exit open positions when the close drops below the stop loss. I wanted an additional exit of all positions if the market was experiencing a rapid downturn.

The below images represent the current simulation behavior of my system that I have been using since 2015 and live traded through March--AB simulation results.

You can see in the below equity chart that there was a nasty drawdown in early 2020. Mentally this was very tough for me to live trade through.

The drawdown is shown in the below drawdown chart in which the portfolio experience around a 20% drawdown.

And the below chart chart shows the simulation performance of my system since 2015

And finally the below chart shows the Monte Carlo simulation results for my system

So as I mentioned earlier, having live traded my weekly system through March the one aspect of my weekly system I wanted to improve was for it to completely exit all positions in extreme downturns (an emergency exit) like we lived through in March. While I've been experimenting with a number of different emergency exits I binned a lot of the techniques I was working on because they became too complicated and convoluted. I'm a firm believer in KISS when it comes to systems so through some trial and error I landed on an emergency exit that simply sold all open positions if for any given week the close of the XAO index was 4.5% down on the open for the week. After running some simulation...wow, what a difference. The system would now deal with a March downturn in a way that is much better suited to my trading style.

The below images are the performance of my system with the new emergency exit. I'm pretty happy with the improved performance and will include in my live system after I do a few more simulations.

The below equity chart clearly shows that the significant drawdown in early 2020 has been greatly reduced.

The reduced drawdown is shown in the below drawdown chart and the COVID drawdown is only around 8% compared to the above standard system that experienced around a 20% drawdown.

The overall system performance since 2015 is shown below

And finally the overall Monte Carlo simulations are below