I think you're right and my simple Fib targets have been thoroughly trampled by this stampede. The bulls are certainly having a great run and more and more bears seem to be capitulating so either, a top of some sort is near, or "this time it's different". The rate of increase of this market is reminiscent of the post 87 crash period so I think I'll continue to sit on my hands and see what happens when we get to 5000. I'm very interested to hear what the EW skeptics anticipate for the future and hope they post in the other XAO thread.Isn't that pretty much textbook wave 5 or wave C psychology (depending on the actual cycle)?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Elliott Wave and the XAO

- Thread starter OzWaveGuy

- Start date

Timmy

white swans need love too

- Joined

- 30 September 2007

- Posts

- 3,457

- Reactions

- 3

There is plenty of prediction going on, on any number of threads. Let's keep this thread free for the EW practitioners to discuss EW, any queries about the methods of others are to be addressed in alternative threads please.

Isn't that pretty much textbook wave 5 or wave C psychology (depending on the actual cycle)?

Exactly. If you look at intraday data there was a very strong impulse wave starting yesterday with wave 4 completing this morning and W5 blowing out and completing before lunch. A good quick intra day trade but for the longer term it's my experience that most trends complete with a quick blow off impulse wave, like we just have seen.

There couldn't be to many retail shorts game enough to go short in this market, I'm quite confident the commercials are leverged short after all that action. They however have deep pockets and can keep selling and churning into a rising market.

I have increased my long term shorts with the completion of that impulse wave. The next couple of days will tell whether I run for the exit door or have captured a good entry.

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

EWI is having another FreeWeek starting noon Wednesday, Sept. 16 (USA time) and ending noon Wednesday, Sept. 23. This FreeWeek throws open the doors to EWI's Asian-Pacific and European Short Term Updates.

Could be interesting to see what they have to say about our XAO.

Their assessment of the XAO is very similar to many of the views here. Their ASX chart shows a 3 wave corrective move from the lows with an intervening 'X' wave, terminating at around 4800-4900.

Re: SPI 200 on daily chart

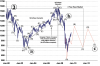

Attached is a day chart (click to expand) showing the Zig Zag correction. The first confirmation required of a possible important top would be a break of the lower blue channel line. Today this sits just above 4600.

Todays expected action on the spi is a sell off from near open. I wouldn't be surprised to see a weak open below 4700 leaving an exhaustion gap in technical terms. The alternative is the gap becomes a break away but in my book given the timing this is unlikely.

If we break the 4600 mark it will be interesting to see if the market can break through the Fib. retracements in days to come. A break of the lower support line would be final confirmation, if it's going to come it will likely be during the next reporting period in October.

I'm quite comfortable being short but for now it's just sit and watch what unfolds. A impulse wave 1 down to the lower support line is the expected price action over the next couple of weeks.This would also confirm the trend is still down.

This, if nothing else will be interesting.

Attached is a day chart (click to expand) showing the Zig Zag correction. The first confirmation required of a possible important top would be a break of the lower blue channel line. Today this sits just above 4600.

Todays expected action on the spi is a sell off from near open. I wouldn't be surprised to see a weak open below 4700 leaving an exhaustion gap in technical terms. The alternative is the gap becomes a break away but in my book given the timing this is unlikely.

If we break the 4600 mark it will be interesting to see if the market can break through the Fib. retracements in days to come. A break of the lower support line would be final confirmation, if it's going to come it will likely be during the next reporting period in October.

I'm quite comfortable being short but for now it's just sit and watch what unfolds. A impulse wave 1 down to the lower support line is the expected price action over the next couple of weeks.This would also confirm the trend is still down.

This, if nothing else will be interesting.

Attachments

Jay, I agree with you that the correction could well be complete and my thinking is similar to yours re that lower support line. FWIW, we are close to the Spring equinox.

I’m still in learning mode but if we break below it, I’ll be tempted to try an AGET “Type 2” trade (selling at the end of a Fifth Wave rally). Of course, that will be a signal for everyone else to buy.

That 2.618 target now doesn’t look so bad and those smart enough to have bought around 3850 (wish I was one of them) could have made a profit of about $850 per IQ CFD. (Of course those who bought around 3200 are even smarter!)

As OWG pointed out, EWI have a target of about 4900 and they think we might have just completed a third wave within their wave C with more upside to come. I’m not so sure about that but, as always, time will tell.

I’m still in learning mode but if we break below it, I’ll be tempted to try an AGET “Type 2” trade (selling at the end of a Fifth Wave rally). Of course, that will be a signal for everyone else to buy.

That 2.618 target now doesn’t look so bad and those smart enough to have bought around 3850 (wish I was one of them) could have made a profit of about $850 per IQ CFD. (Of course those who bought around 3200 are even smarter!)

As OWG pointed out, EWI have a target of about 4900 and they think we might have just completed a third wave within their wave C with more upside to come. I’m not so sure about that but, as always, time will tell.

Attachments

Jay, I agree with you that the correction could well be complete and my thinking is similar to yours re that lower support line. FWIW, we are close to the Spring equinox.

I’m still in learning mode but if we break below it, I’ll be tempted to try an AGET “Type 2” trade (selling at the end of a Fifth Wave rally). Of course, that will be a signal for everyone else to buy.

That 2.618 target now doesn’t look so bad and those smart enough to have bought around 3850 (wish I was one of them) could have made a profit of about $850 per IQ CFD. (Of course those who bought around 3200 are even smarter!)

As OWG pointed out, EWI have a target of about 4900 and they think we might have just completed a third wave within their wave C with more upside to come. I’m not so sure about that but, as always, time will tell.

Chris you might be right with that 3rd wave. I'll be closing shorts now if we retrace this recent down move by more than 61.8% and looking to short again higher. I think the key is what happens tonight. The uS does have some catching up to do compared to most other countries.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,532

- Reactions

- 9,893

I find the short term analysis of EW confusing.

I mainly use it on long term monthly charts.

I'm still pessimistic on "the recovery" and "the recession" being over.

So looking at long term support/resistance lines and running a fibonnaci retracement from the madness of the recent bull high, I posit that we are at the top of a 4th wave, and that the fifth will commence come october, and finish at 1800 on the xao.

The blue sky that went up from 2004 to the recent highs will not be equalled for another 7 or 8 years if you run a trend line from the lows of 1992 through the lows of 2000-2003.

I'm on this wave 4 with extremely close stops.

A recovery it ain't.

Maybe we'll not hit 1800, more likely 2400, but as for 5200 or 6800, forget it.

gg

I mainly use it on long term monthly charts.

I'm still pessimistic on "the recovery" and "the recession" being over.

So looking at long term support/resistance lines and running a fibonnaci retracement from the madness of the recent bull high, I posit that we are at the top of a 4th wave, and that the fifth will commence come october, and finish at 1800 on the xao.

The blue sky that went up from 2004 to the recent highs will not be equalled for another 7 or 8 years if you run a trend line from the lows of 1992 through the lows of 2000-2003.

I'm on this wave 4 with extremely close stops.

A recovery it ain't.

Maybe we'll not hit 1800, more likely 2400, but as for 5200 or 6800, forget it.

gg

Attachments

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

I'd be interested in what sort of news event is going to be required to create a drop to 2400 or lower. The US market is continuing to shrug off bad news, so whats it going to take to see a massive change in the crowd psychology?

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,532

- Reactions

- 9,893

I'd be interested in what sort of news event is going to be required to create a drop to 2400 or lower. The US market is continuing to shrug off bad news, so whats it going to take to see a massive change in the crowd psychology?

I'm a chartist mate not a funnymentalist, but .. Obama gets shot, BinLaden gets the Pakistan Atom Bomb, Some flu or other virus takes out 2 billion consumers, China decides to go back to Maoism, meteorite wipes out Texas, who knows.

gg

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Is it at all possible that the fall from 6800 to 3100 (range = 3700. duration ~15 months) was in fact a protracted wave 1, and we are now in the counter trend wave 2? Assume this wave 2 goes for 50-61.8% of wave 1, that would imply an end of the recent rally at 4950 to 5400, by end of this year. Is that even a plausible scenario?

USA defaulting on its treasuries would be a good one. Probably not gonna happen for a couple of years, however.

I'd be interested in what sort of news event is going to be required to create a drop to 2400 or lower. The US market is continuing to shrug off bad news, so whats it going to take to see a massive change in the crowd psychology?

USA defaulting on its treasuries would be a good one. Probably not gonna happen for a couple of years, however.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,532

- Reactions

- 9,893

Is it at all possible that the fall from 6800 to 3100 (range = 3700. duration ~15 months) was in fact a protracted wave 1, and we are now in the counter trend wave 2? Assume this wave 2 goes for 50-61.8% of wave 1, that would imply an end of the recent rally at 4950 to 5400, by end of this year. Is that even a plausible scenario?

I'm no expert on EW, but yes your scenario is correct , each wave can be reduced to a further ew pattern, but I'm unsure if we can do so with 2 waves.

We need tech/a to expand.

gg

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

More related to the US markets than then XAO, but is interesting to note that Glenn Neely has finally flipped his opinion and said he's not expecting new lows now. He's now saying it's quite possible a contracting triangle will form from here until 2012 and end at a higher point than this year's lows. If this is the case, then he expects that the lows from earlier this year won't be breached again ever(well he said for the next 50 years but it might as well be the same thing for most adults currently around!).

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,532

- Reactions

- 9,893

More related to the US markets than then XAO, but is interesting to note that Glenn Neely has finally flipped his opinion and said he's not expecting new lows now. He's now saying it's quite possible a contracting triangle will form from here until 2012 and end at a higher point than this year's lows. If this is the case, then he expects that the lows from earlier this year won't be breached again ever(well he said for the next 50 years but it might as well be the same thing for most adults currently around!).

Prof can you expand with a chart

gg

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

Prof can you expand with a chart

gg

here you go gg

Attachments

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

I'd be interested in what sort of news event is going to be required to create a drop to 2400 or lower. The US market is continuing to shrug off bad news, so whats it going to take to see a massive change in the crowd psychology?

Bad news or Good News - it won't matter. In bull markets, bad news is simply shrugged off, and in bear markets the good news is shrugged off. The psychology of the crowd is in the driving seat.

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

Bad news or Good News - it won't matter. In bull markets, bad news is simply shrugged off, and in bear markets the good news is shrugged off. The psychology of the crowd is in the driving seat.

So we are in a new bull market then?

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

I'm a chartist mate not a funnymentalist, but .. Obama gets shot, BinLaden gets the Pakistan Atom Bomb, Some flu or other virus takes out 2 billion consumers, China decides to go back to Maoism, meteorite wipes out Texas, who knows.

gg

So your saying that some major news event must take place for your 2400 target to into fruition?

- Joined

- 20 November 2005

- Posts

- 787

- Reactions

- 92

The triangle scenario has been in play for 2-years in my opinion. Here is a report I wrote in March 2007, page 6 specifically looks at the triangle:

March 2007 - A Major Top

And updated again in March 2009:

March 2009 - A Major Low

Nick

This post may contain advice that has been prepared by Reef Capital Coaching ABN 24 092 309 978 (“RCC”) and is general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice you should therefore consider the appropriateness of the advice having regard to your situation. We recommend you obtain financial, legal and taxation advice before making any financial investment decision.

March 2007 - A Major Top

And updated again in March 2009:

March 2009 - A Major Low

Nick

This post may contain advice that has been prepared by Reef Capital Coaching ABN 24 092 309 978 (“RCC”) and is general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice you should therefore consider the appropriateness of the advice having regard to your situation. We recommend you obtain financial, legal and taxation advice before making any financial investment decision.

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

The triangle scenario has been in play for 2-years in my opinion. Here is a report I wrote in March 2007, page 6 specifically looks at the triangle:

And updated again in March 2009:

March 2009 - A Major Low

Nick

Greetings Mr. Radge,

In your report I notice a chart projecting a March 2009 low revisited around 2011-2012. On what fundamental basis would this happen or is this projection based solely on a longer term period of consolidation (triangle)?

Similar threads

- Replies

- 31

- Views

- 4K

- Replies

- 0

- Views

- 5K

- Replies

- 0

- Views

- 3K