- Joined

- 13 January 2011

- Posts

- 372

- Reactions

- 16

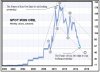

And the base keeps running, running and running, running...

As for now, third wave is in progress, and better not to do some stupid action like sell and try to pick up cheaper. Third waves can go beyond anything one can expect.

In theory there could be a 200+ point correction somewhere between now and 6100 if this abides by the rules.

(click to expand)

rimtas, our previous EW'ers failed dramatically. Only ever correct in select retrospect. Love your work.

Thanks for the generous feedback rimtas. Always in good spirit.Hi Kennas,

EW is simple, but only when you have an artistic mind which can spot something majority can't; and the scientific approach, that can fit those patterns into larger perspective. So Art and Science comes together here.

Technically EW is not much better than any other TA, because at the any given moment all rules and guidelines could be successfully applied to forecast both directions. That's why internet is full of Elliott technicians with plenty of different counts. But very little of them understand how their counts are connected with economy, and social action.

I believe that humans en masse act unconsciously, and their behaviour is patterned. Social sciences explaining and observing this are at the dawn and many years will pass until theory turns into real thing. But some universities in US are already accepting this idea and you can find socionomics and EW in their curriculums.

So practically applying EW to make money one must rely on the little data their have and even less examples of what social action means, what kind of wave it represents. Give me 1000 or 10.000 years of market data and I can tell with great confidence where the current market and economy is located and forecasting next 100 years with great accuracy would be a piece of cake.

But now when we have 100-200 years of data only, this peace of information is highly speculative, it can represent any wave sequence and next wave could always be the last. So even EW at this point can not tell what the future holds, and I personally try not to forecast more than 5-10 years ahead. I put my money only on high confidence patterns that I understand and which fit into given social atmosphere. One more example can be given right away: last Friday there were news with headline:

Economy lacking animal spirits

https://au.news.yahoo.com/a/26287614/economy-lacking-animal-spirits-rba/

RBA was close, but it missed one great thing-animal spirits are already roaring through the whole country month or so(as well as through Asia region), and this is recorded by stock prices. Current social action will result in improved economic figures later, because social mood is improving. So RBA will get it's numbers later in the year, where it can say that "oh, finally animal spirits started to pick up". But truth is that they picked up month ago.

This statement comes to light exactly at the moment when animal spirits bottomed in wave (2) and the strongest part of the sequence started. At the dawn of the rise everybody is crying how bad things are, because not rising market makes social mood go down, and at the end they just explode.

I also liked the RBA phrase that animal spirits "are unforecastable". But if you can forecast economy, why you can't forecast the reasons of economic improvement? In the end, economy is just the lagging factor of social actions, driven by herding behaviour.

I can go on, but hardly it has any use here, people in this kind of forums are looking for information that could help them to back up their opinions about market direction...which for most of them are moving in linear fashion and driven by news or government actions. I believe this is the reason why most of them loose money-because they use information, which already is a result of a previously dominated trend.

Cheers

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.