Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,207

- Reactions

- 22,126

And, whatever happened to "Win Win"?I've no doubt the cost will end up very much higher but it's the concept I'm interested in.

These things take time, they don't happen overnight and I'm thinking in terms of a turning point of the kind Wethat to most will be apparent only many years after the event. I'm not expecting to see anything dramatic next week etc.

Much like Australian state politicians generally didn't acknowledge any decline of manufacturing until well into the 1990's. Prior to that, they were still going to elections talking up the prospects of someone building a factory - never mind that the sector had been declining for 20 years by that point, it took a very long time to sink in.

Or for a less serious example, Rock music peaked in 1983 and outright fell off the cliff after 1989. Factually correct from a commercial perspective as a % of music sales but I expect there'd be more than a few who took the next 20 years to realise that such a fundamental shift had taken place. Most would've been thinking in terms of individual bands having passed their peak, not grasping that the entire genre was headed to oblivion so far as the mainstream is concerned. That's US data but would be much the same in Australia.

I may well be wrong but I do get a definite impression that a turning point has occurred of that nature. Won't be noticeable for a while but the political language does seem to have shifted away from the whole 1970's - 2019 thinking of "free trade", "there is no such thing as society", "government debt is always bad" and so on and toward "need to make things here" and "need to focus on lifestyle not just money" and "government needs to invest" etc. That's a profound change that, if continued, will ripple through pretty much everything over time just as the changes in the 70's - 80's did.

The examples I've given are just to illustrate really, it's the sentiment I'm looking at and pondering where that leads more broadly?

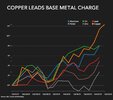

One of the more obvious implications is inflation. Government borrows heavily and inflates it away meanwhile a shift of at least some production to developed countries with higher production costs. The ideas in the US of increasing tax rates are another one that goes against the paradigm of recent decades.

Individually each can be dismissed, but not if there's a pattern forming.