over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,290

- Reactions

- 7,500

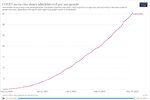

And it's looking like a choppy night tonight. Futures were all in the green with the nasdaq overwhelmingly the highest but asia's had a pretty shite day so everything's flipped to either flat or mildly negative. We'll see how much the U.S market really care about asia. Microcaps seem to be keeping their head above water and whilst being choppy like you wouldn't believe, are already back above their pre-slump high:

So as said previously, plenty of chop to come yet.

So as said previously, plenty of chop to come yet.