- Joined

- 8 June 2008

- Posts

- 13,242

- Reactions

- 19,545

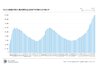

you would be right if "rules" of economics were to apply, but they do not; there is a massive voluntary transfer of wealth toward the .01%I understand what you are saying, and I appreciate that wealth has just been transferred from one group of people to another, but it seems to me that there are other factors at play.

Those Wall Street people had jobs before and they have jobs now. Those Mums and Dads who owned businesses had jobs before and don't now. They're probably on unemployment benefits with a mortgage they can no longer pay. This must be happening all across the country en masse and eventually the chickens will come home to roost.

I just don't feel that this is a time for celebration and running up the stock market. The true economic effects of this pandemic are yet to be fully felt in my view.

There is a real economic cost to be paid for all these destroyed industries and small businesses and I think that the market is not currently figuring that into the equation. It seems to me to be irrational exuberance. We are not out of the woods yet, far from it.

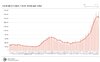

This V-shaped recovery seems to be out of step with reality and I think the market has overshot the mark by a significant margin.

Time will tell of course, but I remain pessimistic.

stimulus and stimulus, not so much for the corner stores or sacked workers doing it hard but for the master of the universes, paid by debt to be repaid by the losers: you know the 99.9 we all belong;

Under the guise of helping the street and protecting the 80+olds from ever dying, the biggest wealth transfer we have even seen and i would bet it will not end nicely, not by basic economics..like $ value collapse etc, all that would only work in a free market, which we are not.

SO whether you like it or not, your best bet is to join the robbers, knowing very well that your chances are small to win when the masters will decide to stop the market, release or stop a pandemic or seize assets with a long list of good reasons and a pretext of robbing the richs to distribute to the poor.

reduce your liabilities: fixed assets, individual bank accounts move to crypto and gold, and play the game following Mr Ducati or Mr Over9k

probably no radical drama to expect until next year..July August when holidays are priorities in the Northern hemisphere and legislative framework will be in place.

I expect this to be true in both Europe and US and so for the rest of us : July 2021 deadline..let's see