over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,311

- Reactions

- 7,567

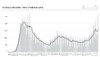

But the fact is that the real key metric here is this one:

Fact is that the real number which will bring the country to its knees is hospitalisations. Not only that, but medical staff numbers off work sick is increasing at the same time as hospitalisations are, so the healthcare system is very seriously looking like buckling under the strain.

At least the authorities, incompetent as they are, are starting to recognise this though.

View attachment 115676

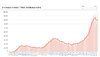

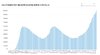

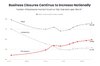

Agree.Oh yeah wayne. The big players are cleaning house left, right, and centre. This year has had the largest number of buyouts, takeovers, and mergers in history.

Every single business that goes to the wall is a business that can be absorbed by whatever players remain. Corporate lawyers etc have never been so busy.

Worst case the existing players pick up the market share directly rather than absorb the company/business that's gone to the wall, so either way, the bigger you are, the more you win.

Unless you're one of those small & unique/new disruptive growth companies that's increased/benefited tenfold from the pandemic (like zoom), you are f***ed.

View attachment 115896View attachment 115897

But don't worry, it's going to get worse:

View attachment 115895View attachment 115898

View attachment 115899

Bloomberg - Are you a robot?

www.bloomberg.com

Covid-19 cases in Los Angeles will reach 500,000 by the end of the year based on the current pace of infection, and deaths could surpass 11,000, Mayor Eric Garcetti said... “We’re perilously close to running out of ICU beds,” Garcetti said in a briefing, calling the outbreak “the greatest threat to lives in Los Angeles... At this rate of infection, Los Angeles will be out of hospital beds in two to four weeks", he said.

Meanwhile, the stock market continues to scream, with futures already at this point and it's not even sunday:

View attachment 115900

I keep saying that you can't beat this, fighting it is an exercise in futility. As frog said previously, your only hope is to get on board with it before you get left behind.

Big banks have recovered way more despite not being hit as hard as the smaller regional ones. Ergo, it's not simply a question of one class being more volatile than the other like with some other sectors - you're better off with your cash in big banks rather than smaller ones either way:

Yes the problem with the banks is, if t hey are making money people are lpsing money.@over9k although percentage wise all banks have recovered about the same amount, I would agree big banks are likely a better option than the smaller ones but we still need to be careful of which big banks we go with. NAB and WBC are not real standouts over the years.

View attachment 115909

Banks here in Oz are a bit different as the banks here are most and nearly only real estate, so different from the US and europeYes the problem with the banks is, if t hey are making money people are lpsing money.

So it is seen as as the banks robbing their clients, which is the general public.

On the other hand, if they dont make money, they cant lend money.

It is a real conundrum.

Oh yeah wayne. The big players are cleaning house left, right, and centre. This year has had the largest number of buyouts, takeovers, and mergers in history.

Every single business that goes to the wall is a business that can be absorbed by whatever players remain. Corporate lawyers etc have never been so busy.

Worst case the existing players pick up the market share directly rather than absorb the company/business that's gone to the wall, so either way, the bigger you are, the more you win.

Unless you're one of those small & unique/new disruptive growth companies that's increased/benefited tenfold from the pandemic (like zoom), you are f***ed.

View attachment 115896View attachment 115897

But don't worry, it's going to get worse:

View attachment 115895View attachment 115898

View attachment 115899

Bloomberg - Are you a robot?

www.bloomberg.com

Covid-19 cases in Los Angeles will reach 500,000 by the end of the year based on the current pace of infection, and deaths could surpass 11,000, Mayor Eric Garcetti said... “We’re perilously close to running out of ICU beds,” Garcetti said in a briefing, calling the outbreak “the greatest threat to lives in Los Angeles... At this rate of infection, Los Angeles will be out of hospital beds in two to four weeks", he said.

Meanwhile, the stock market continues to scream, with futures already at this point and it's not even sunday:

View attachment 115900

I keep saying that you can't beat this, fighting it is an exercise in futility. As frog said previously, your only hope is to get on board with it before you get left behind.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.