over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,311

- Reactions

- 7,567

USA vs Europe:

The consensus among the talking heads is that the U.S is about two-ish weeks behind europe at the moment, so let's take a look at where europe is now and see if we can extrapolate that to the U.S a couple of weeks from now.

In short, the lockdowns are having the exact effect you'd expect. Virus numbers have subsided/turned the corner:

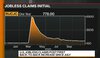

But economically speaking, it's a bloodbath, shown by new PMI data out today:

Result? Even the talking heads can see that europe's heading for another slump:

The one major difference is that the yanks do thanksgiving whereas europe does not. Thanksgiving will be the mother of all superspreader events, so whilst we might have numbers in the U.S subside slightly, we can expect a huge bounce after thanksgiving/just before christmas.

The U.S and Europe obviously both do christmas though, and so both are going to see major spikes after that. The difference is that the yanks are likely to be starting from a much higher level on account of thanksgiving and so will have much worse post-christmas numbers.

The consensus among the talking heads is that the U.S is about two-ish weeks behind europe at the moment, so let's take a look at where europe is now and see if we can extrapolate that to the U.S a couple of weeks from now.

In short, the lockdowns are having the exact effect you'd expect. Virus numbers have subsided/turned the corner:

But economically speaking, it's a bloodbath, shown by new PMI data out today:

Result? Even the talking heads can see that europe's heading for another slump:

The one major difference is that the yanks do thanksgiving whereas europe does not. Thanksgiving will be the mother of all superspreader events, so whilst we might have numbers in the U.S subside slightly, we can expect a huge bounce after thanksgiving/just before christmas.

The U.S and Europe obviously both do christmas though, and so both are going to see major spikes after that. The difference is that the yanks are likely to be starting from a much higher level on account of thanksgiving and so will have much worse post-christmas numbers.