over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,386

- Reactions

- 7,757

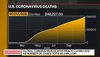

Alright so let's dispense with the weekend virus news before we get to the meaty stuff:

Please note that this has barely been covered today (most of this is from the weekend) on account of the, you know, vaccine news, but that doesn't mean it's gone away and I suspect the news will be right back on it now that the vaccine stuff is over on account of the aforementioned virus lack-of-going-away. Do NOT dismiss this as irrelevant now or something. It'll be right back all over the news pretty bloody quickly I suspect.

Please note that this has barely been covered today (most of this is from the weekend) on account of the, you know, vaccine news, but that doesn't mean it's gone away and I suspect the news will be right back on it now that the vaccine stuff is over on account of the aforementioned virus lack-of-going-away. Do NOT dismiss this as irrelevant now or something. It'll be right back all over the news pretty bloody quickly I suspect.