MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

@MovingAverage thanks for the share, trading is a lonely hobby & without members like yourself posting actual returns others have no way of benchmarking their returns. @qldfrog & @Warr87 are doing the same on a weekly basis. As I've said before "Sharing is caring" & it motivates all of us to strive for better.

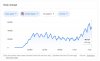

The COVID-19 Flash Crash

This "black swan event" has affected us all & it's worthy to explore how we go somewhat to find a way to cushion the blow of the next one.

View attachment 107321

Skate.

I definitely think that the rapid and relentless drop we saw in March is a challenge for the standard WTT...waiting so long to exit positions...yikes. As mentioned I've addressed that now with an "emergency exit".