tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,520

Hey Skate.

Have you posted any back-test results, which cover the GFC period? From the back-tests I have done on similar strategies, the GFC period was particularly detrimental (lots of whipsawing into a down-trending market). The current trend-following system I'm trading (for the past 6 years) was selected on one of the basis's being a benign GFC outcome.

Good work on reigniting the systematic trend-following interest on this forum. Ironically, the last period in which there was such a great interest was just prior to the GFC - I visit the archived graveyard once a while.

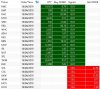

A random sample back-test run for my system:

View attachment 93754

Words of wisdom.

Please think before you reply to a post.

THINK

T - is it true?

H - is it helpful?

I - is it inspiring?

N - is it necessary?

K - is it kind?

I love this one .... you posted ... I at times find myself in the midst of discussions and opinions where ... some post stuff, opinions, beliefs, and at times based upon faith or hatred which they believe I suspect is true, not helpful, not inspiring to be told someone hates something or some group or issue, not necessary and really not kind. What does one do in the face of being trolled ? By someone who is so sick they hate something illogically or deny science or evidence of impeachable empirical unquestionable nature and then deliberately .... to get attention ... post an opposing view based upon what they know ill annoy, frustrate and deliberately cast doubt upon an issue.

This is a common tactic of modern times. Smoking and its ill effects, for 30 years the tobacco industry employed such tactics, till ... that changed. People with fears about say a religion or persons skin color or their beliefs, the anonymous internet is a wonderful place for them to emerge and spread their hate. Based upon free speech or some new idea its ok to be intolerant and abusive and show it with gusto.

How does one respond when its n0ow the normal for say a news media outlet overseas to be like this ? Spread hate, fear about topics based on not fact, but crap ?

Interesting and scary world where even leaders do it and base a decision upon not a group of experts he has to advise him, or science, or impartial examination of facts and cause and effect, but to operate on an opinion based upon listening and reading crap ?

That was a dump .... sorry ... but wisdom and best practice and scientific know best practice verses putting your head in the sand or being racist, or greedy separates us from most other species, or at least used to. We revert back to this base state, time and time and time again on a global level.

Whilst K.I.N.D is a good policy to follow, at times, boundaries and trolls ensure that even the most tolerant and open to others views and opinions are taken to places where, well .... if one failed to respond to a Troll and their lack of humanity as is seen say on the Christchurch thread here, it leaves the definition of who you are as being human, not saying NO ... openly and without anger that someone posting with glee over such an event makes you sick ... if you don't openly say your missing parts, for me, my values .... I sadly cant and will not accept. Not trying to foist my own beliefs upon others, but there is a line where all this free speech and hate speech couched in what appears to be discussion but is NOT ...

Wow still dumping ... sorry.

Skate, i think the image link might be wrong?

the cam strategy post ends with an image about the power of compounding? Was it your purpose?I'm unsure of the image link you are referring to..

Skate.

T

the cam strategy post ends with an image about the power of compounding? Was it your purpose?

@Gringotts Bank as no one reads this thread let me indulge..

Exercise #1

I purposely offend & upset some, I'll bring them to a rage (I'll milk that rage for all its worth)

Then I set out to condition them & have them apologise for misunderstanding me.

After a fair bit of their grovelling - I gracefully accept there apology while letter them know how hurt I was.

Now that takes skill.

I won't bore you with the others examples..

Skate.

@barney its a means to an end.

Its not a want its a must (people must do what I want them to do without them knowing - its in my best interest)

If people realise what I do, I lose, its that simple (people don't feel the conditioning)

Formula

Perception = Reaction

So..

I setup their perception & get the reaction I want (simple formula)

It's all about money..

Honing my skills - sometimes I do it for fun but mostly so I keep on top of my game.

Skate.

Skate

Interesting disclosures about how you interact with others.

Still not really clear what is in it for you to behave like this....orn

Hi

I still dont understand firstly why you would seek to behave like this or secondly why you are disclosing it. Unless it is in some part of the financial world where the dumbest manipulator loses...which I think you do allude to. But outside of that?

The ‘Dump it here’ thread was started in the hope of helping new members those just starting out on their trading journey. I lost interest very quickly in the thread as there was a lack of interaction, I was just repeating information I already knew & it felt as if I was talking to myself. I twisted & turned the thread & at times I was confrontational but that was even short lived.

i also do not like the odds of THE big crash ahead

Feeling very spoiled and thankful reading the numerous weekly systematic trading reports on ASF currently.

Skate, a question please - I suspect you would have modelled the effect of trading your Hybrid and CAM strategies together. I believe you've mentioned before the correlation was relatively low, at least in terms of tickers with Buy signals, but it would be interesting to know if the combined equity curve is flatter, magnifies the period that trend following is successful and times that drawdowns occur. I'm sure you have market filters for both strategies to limit the DD, but interested if your (expected/modelled) equity curve is now flatter?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.